20+ Military Pay Calculations: Master Your Finances After Taxes

Understanding your military pay, especially after taxes, is crucial for effective financial planning. In this comprehensive guide, we'll delve into the intricacies of military pay calculations, covering everything from basic pay to special pays and deductions. Whether you're a newly enlisted soldier or a seasoned veteran, mastering your finances starts with a solid grasp of your pay structure.

Basic Pay: The Foundation of Your Income

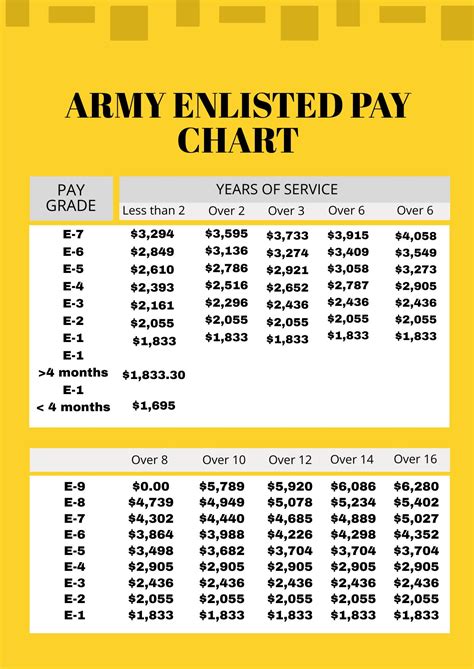

Basic pay forms the core of your military compensation and is determined by your rank and years of service. It follows a standardized pay table set by the Department of Defense (DoD), ensuring fairness across all branches.

Here's a simplified breakdown of how basic pay works:

-

Rank and Paygrade: Your military rank, ranging from E-1 to O-10, corresponds to a specific paygrade. For instance, an E-1 recruit might start with a basic pay of $1,733.10 per month, while an O-10 general could earn upwards of $16,151.70 monthly.

-

Years of Service: As you progress in your military career, your basic pay increases with each promotion and year of service. This provides a steady and predictable income stream, fostering financial stability.

It's important to note that basic pay is just the beginning. Your total compensation package includes various other pays and allowances, each serving a unique purpose.

Special Pays: Enhancing Your Military Income

In addition to basic pay, military members are eligible for a range of special pays, each designed to compensate for specific duties, skills, or deployments. These pays can significantly boost your overall income and provide incentives for certain roles.

1. Flight Pay

Flight pay, also known as aviation career incentive pay (ACIP), is awarded to military personnel with flight-related duties. The amount varies based on your rank and the type of aircraft you operate, with potential earnings reaching several thousand dollars annually.

2. Hazardous Duty Pay

As the name suggests, hazardous duty pay is granted to service members engaged in dangerous or hazardous operations. This could include tasks like underwater demolition, combat operations, or exposure to harmful substances. The pay is typically around $150 per month, offering a valuable supplement to your basic income.

3. Dive Pay

Similar to flight pay, dive pay is awarded to military divers who perform underwater operations. The amount depends on the depth and duration of dives, with potential earnings of $100 to $300 per month.

4. Hardship Duty Pay

Hardship duty pay recognizes the challenges of serving in remote or less desirable locations. It's designed to compensate for the additional hardships and expenses associated with such postings. The pay varies based on the specific location and can range from a few hundred to several thousand dollars annually.

5. Imminent Danger Pay

Imminent danger pay is a critical component of military compensation, providing an extra layer of financial protection for service members deployed to high-risk areas. This pay, typically around $225 per month, is a testament to the bravery and sacrifice of those serving in dangerous environments.

Allowances: Supporting Your Daily Needs

Allowances are a crucial part of your military compensation, designed to cover specific expenses related to your service. These include:

1. Basic Allowance for Housing (BAH)

BAH is a significant allowance, providing financial support for your housing needs. The amount varies based on your rank, dependency status, and the cost of living in your duty station. It's intended to cover rent, utilities, and other housing-related expenses, ensuring you have a comfortable and secure home.

2. Basic Allowance for Subsistence (BAS)

BAS is a fixed allowance to cover your food expenses. It's typically around $420 per month, helping to offset the cost of meals, whether you choose to dine in the military dining facility or prepare your own meals.

3. Variable Housing Allowance (VHA)

VHA is an additional allowance for service members who live off-base but within a certain proximity. It's designed to bridge the gap between BAH and the actual cost of housing, ensuring you're not financially burdened by off-base living.

Deductions and Taxes: Understanding Your Take-Home Pay

While your military pay includes various components, it's essential to understand the deductions that impact your take-home income. These deductions include:

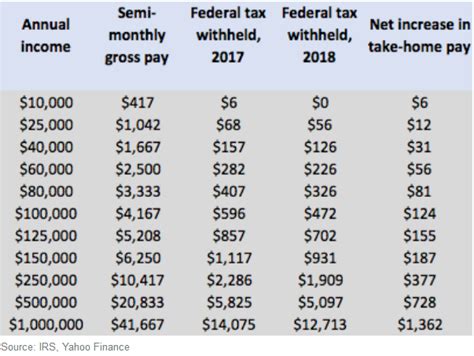

1. Federal Income Tax

Like all U.S. citizens, military members are subject to federal income tax. The amount deducted depends on your filing status, income level, and any applicable tax credits or deductions.

2. State Income Tax

State income tax varies by state, with some states exempting military income from taxation. It's crucial to understand your state's tax laws to accurately calculate your deductions.

3. Social Security and Medicare Taxes

Social Security and Medicare taxes are mandatory deductions, ensuring your eligibility for these crucial social programs. These deductions are a vital part of your overall financial planning.

4. Other Deductions

Your pay stub may include other deductions, such as life insurance premiums, retirement contributions, or voluntary allotments. Understanding these deductions is essential for managing your finances effectively.

Calculating Your Military Pay: A Step-by-Step Guide

Calculating your military pay involves a series of steps, each building upon the last. Here's a simplified guide to help you understand the process:

-

Determine Your Basic Pay: Start by referring to the military pay tables based on your rank and years of service. This will give you a clear idea of your basic pay.

-

Add Special Pays: If you're eligible for any special pays, such as flight pay or hazardous duty pay, add these amounts to your basic pay.

-

Calculate Allowances: Next, calculate your allowances, including BAH, BAS, and any other applicable allowances. These amounts are based on your rank, dependency status, and duty station.

-

Subtract Deductions: Deduct any applicable taxes and other mandatory deductions from your total pay. This includes federal and state income taxes, Social Security, and Medicare taxes.

-

Calculate Your Take-Home Pay: Finally, subtract any voluntary deductions, such as life insurance or retirement contributions, to arrive at your net pay – the amount you'll actually receive.

It's important to note that this guide provides a simplified overview. For a more accurate calculation, consider using the official military pay calculators available online, which take into account all relevant factors.

Maximizing Your Military Income: Strategies and Tips

Maximizing your military income involves more than just understanding your pay structure. Here are some strategies and tips to help you make the most of your military compensation:

1. Take Advantage of Special Pays

If you're eligible for special pays, ensure you're receiving them. Whether it's flight pay, hazardous duty pay, or imminent danger pay, these additional earnings can significantly boost your income.

2. Optimize Your Allowances

Understand the various allowances available to you and ensure you're receiving the maximum benefit. For instance, if you're entitled to BAH, make sure you're claiming the correct rate based on your duty station and dependency status.

3. Minimize Deductions

While certain deductions, like taxes, are mandatory, there may be opportunities to minimize others. For example, you can adjust your W-4 form to ensure you're not overpaying on federal income tax.

4. Utilize Military Discounts

Many businesses offer military discounts, from restaurants to retailers. Take advantage of these discounts to stretch your income further and enjoy savings on everyday expenses.

5. Stay Informed

Stay up-to-date with military pay updates and changes. The DoD regularly adjusts pay rates and introduces new benefits. By staying informed, you can ensure you're aware of any changes that impact your income.

Military Pay Calculators: Simplifying the Process

Calculating your military pay manually can be complex and time-consuming. Fortunately, several online tools and calculators are available to simplify the process. These calculators consider all relevant factors, including your rank, years of service, special pays, allowances, and deductions.

Some popular military pay calculators include:

Using these calculators, you can quickly and accurately estimate your military pay, ensuring you have a clear understanding of your financial situation.

Conclusion: Taking Control of Your Military Finances

Understanding your military pay calculations is a crucial step toward financial empowerment. By grasping the intricacies of basic pay, special pays, allowances, and deductions, you can make informed decisions about your finances and plan for a secure future. Remember, your military pay is more than just a number – it's a tool to build wealth and achieve your financial goals.

FAQ

How often are military pay rates updated?

+Military pay rates are typically updated annually, with the new rates effective on January 1st of each year. These updates are based on the Economic Value of the Government Employees (EVGE) index, ensuring that military pay keeps pace with inflation.

Are there any tax benefits for military members?

+Yes, military members may be eligible for certain tax benefits, such as the Combat Zone Tax Exclusion. This exclusion allows service members to exclude certain income from taxation while serving in designated combat zones. Additionally, military members may be able to deduct unreimbursed moving expenses and take advantage of the Earned Income Tax Credit (EITC) if eligible.

Can I negotiate my military pay?

+No, military pay is based on a standardized pay table set by the Department of Defense (DoD). While there is no room for negotiation, you can maximize your income by taking advantage of special pays, optimizing your allowances, and minimizing deductions.

What happens if I deploy to a high-risk area?

+If you’re deployed to a high-risk area, you may be eligible for imminent danger pay. This additional pay recognizes the increased risk and potential dangers associated with your deployment. It’s important to understand the specific criteria and requirements for imminent danger pay, as it can vary based on your branch of service and the nature of your deployment.

Are there any resources to help me manage my military finances?

+Absolutely! The Military OneSource website offers a wealth of financial resources, including budgeting tools, financial planning guides, and access to financial counselors. Additionally, many military bases have financial readiness programs and workshops to help service members and their families navigate their finances effectively.