7 Tips To Design The Ultimate Case Western Financial Aid Strategy Today

Introduction

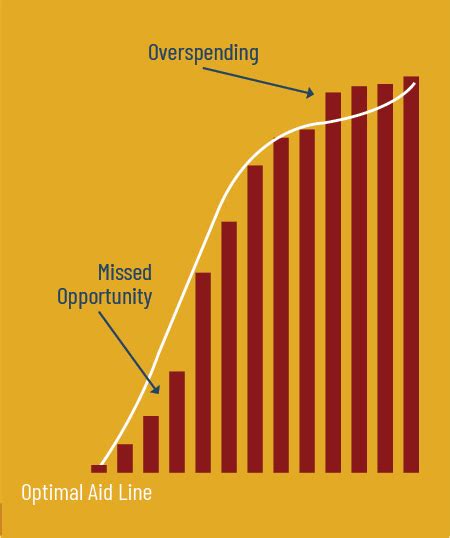

Crafting an effective financial aid strategy is crucial for students aiming to pursue their academic journey at Case Western Reserve University. With the rising costs of higher education, it’s essential to explore all available options and create a well-thought-out plan to fund your education. In this blog post, we will guide you through seven essential tips to design the ultimate Case Western financial aid strategy, ensuring you have the resources needed to succeed.

1. Understand the Cost of Attendance

Before diving into financial aid options, it’s crucial to have a clear understanding of the cost of attendance at Case Western. This includes tuition fees, room and board, books and supplies, and other miscellaneous expenses. By having a comprehensive overview of the costs, you can better assess the financial aid you require and make informed decisions.

Key Takeaway

Note: Start by researching and calculating the total cost of attendance, including all expenses, to get a realistic picture of your financial needs.

Note: Start by researching and calculating the total cost of attendance, including all expenses, to get a realistic picture of your financial needs.

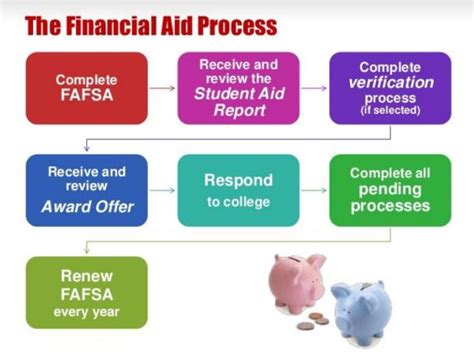

2. Explore Federal Financial Aid Options

Federal financial aid programs are a significant source of funding for many students. Case Western actively participates in these programs, making them accessible to eligible students. Here are some key federal aid options to consider:

- Federal Pell Grants: These grants are need-based and do not require repayment. They are available to undergraduate students with financial need.

- Federal Direct Loans: Federal Direct Loans offer low-interest rates and flexible repayment options. They come in two types: subsidized (need-based) and unsubsidized (non-need-based).

- Federal Work-Study: This program provides part-time jobs to students with financial need, allowing them to earn money to cover educational expenses.

Key Takeaway

Note: Federal financial aid programs are a great starting point. Research and apply for grants, loans, and work-study opportunities to reduce your financial burden.

Note: Federal financial aid programs are a great starting point. Research and apply for grants, loans, and work-study opportunities to reduce your financial burden.

3. Utilize State-Specific Financial Aid

In addition to federal aid, exploring state-specific financial aid options can further enhance your funding opportunities. Many states offer grants, scholarships, and loan programs specifically for residents attending college within their borders. Here’s what you should know:

- Ohio College Opportunity Grant (OCOG): This grant is available to Ohio residents attending eligible colleges, including Case Western. It provides financial assistance based on financial need.

- State Scholarships and Waivers: Some states offer scholarships or tuition waivers to high-achieving students or those pursuing specific fields of study. Check your state’s education department website for details.

Key Takeaway

Note: Don't miss out on state-specific aid. Research and apply for grants, scholarships, and waivers tailored to your state of residence.

Note: Don't miss out on state-specific aid. Research and apply for grants, scholarships, and waivers tailored to your state of residence.

4. Seek Institutional Scholarships and Awards

Case Western offers a range of institutional scholarships and awards to support its students. These opportunities are often based on academic merit, talent, or specific criteria set by donors. Here are some key points to consider:

- Merit-Based Scholarships: These scholarships recognize academic excellence and are awarded based on your academic record and test scores.

- Talent-Based Scholarships: If you excel in areas like music, athletics, or other talents, you may be eligible for talent-based scholarships.

- Need-Based Scholarships: Some institutional scholarships consider financial need as a factor in the selection process.

Key Takeaway

Note: Explore all institutional scholarship opportunities. Apply early and showcase your unique talents, academic achievements, or financial need to increase your chances of receiving these awards.

Note: Explore all institutional scholarship opportunities. Apply early and showcase your unique talents, academic achievements, or financial need to increase your chances of receiving these awards.

5. Consider Private Scholarships and Grants

Private scholarships and grants are awarded by various organizations, businesses, and individuals. These opportunities can significantly reduce your financial burden and are often based on specific criteria or interests. Here’s how to approach private scholarships:

- Research Scholarship Databases: Utilize online scholarship search engines to find opportunities that match your interests, background, and qualifications.

- Community and Local Scholarships: Check with local community organizations, religious groups, or clubs for scholarship opportunities. These scholarships often have fewer applicants, increasing your chances of success.

- Professional Associations: If you plan to pursue a specific career path, explore scholarships offered by professional associations in your field.

Key Takeaway

Note: Private scholarships can be highly competitive. Start your search early, create a strong application, and don't hesitate to apply for multiple scholarships.

Note: Private scholarships can be highly competitive. Start your search early, create a strong application, and don't hesitate to apply for multiple scholarships.

6. Explore Work-Study and Part-Time Job Opportunities

Working while studying can be a great way to earn income and gain valuable work experience. Case Western offers work-study programs and part-time job opportunities on and off-campus. Here’s what you need to know:

- Federal Work-Study: As mentioned earlier, this program provides part-time jobs to students with financial need. It offers a great balance between earning and studying.

- On-Campus Jobs: Case Western offers various on-campus job opportunities, such as library assistants, research assistants, or administrative support roles.

- Off-Campus Jobs: Exploring off-campus job options can provide additional income. Consider jobs that align with your career goals or offer flexible hours to accommodate your studies.

Key Takeaway

Note: Balancing work and studies is possible. Explore work-study programs and part-time jobs to gain financial support and valuable work experience.

Note: Balancing work and studies is possible. Explore work-study programs and part-time jobs to gain financial support and valuable work experience.

7. Utilize Savings and Investment Strategies

While scholarships and grants are ideal, it’s also important to consider your own savings and investment strategies to fund your education. Here are some tips:

- 529 College Savings Plans: These tax-advantaged plans are designed specifically for college savings. Consider opening a 529 plan early to maximize your savings potential.

- Investments: If you have the means, investing in low-risk financial instruments can provide a return on investment to fund your education. Consult with a financial advisor for guidance.

- Tax Benefits: Research tax benefits and deductions available for education expenses. This can help reduce your overall tax liability.

Key Takeaway

Note: Plan your finances strategically. Explore savings plans, investments, and tax benefits to make the most of your financial resources.

Note: Plan your finances strategically. Explore savings plans, investments, and tax benefits to make the most of your financial resources.

Conclusion

Designing an effective financial aid strategy is crucial for students pursuing their academic goals at Case Western Reserve University. By understanding the cost of attendance, exploring federal and state aid options, seeking institutional and private scholarships, and considering work-study and savings strategies, you can create a comprehensive plan to fund your education. Remember, early research and application are key to maximizing your financial aid opportunities. With a well-thought-out strategy, you can focus on your studies and make the most of your time at Case Western.