Insurance

Ama Disability Insurance

Introduction to AMA Disability Insurance

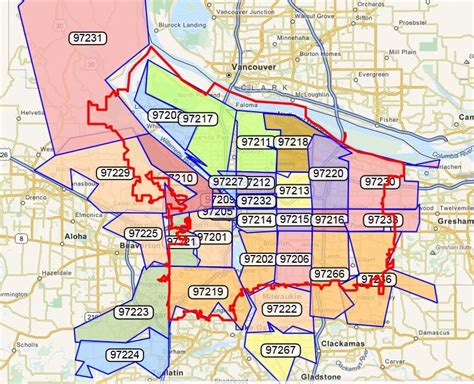

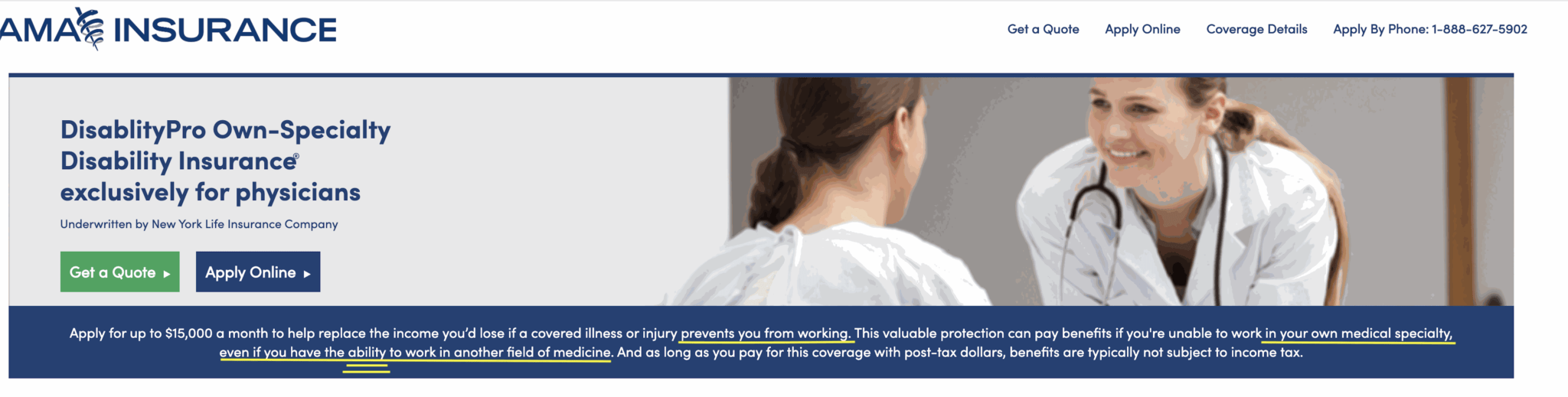

The American Medical Association (AMA) offers disability insurance to its members, providing financial protection in the event of illness or injury that prevents them from working. Disability insurance is a vital component of a physician’s financial planning, as it helps replace income lost due to disability. In this article, we will delve into the details of AMA disability insurance, its benefits, and how it works.

Benefits of AMA Disability Insurance

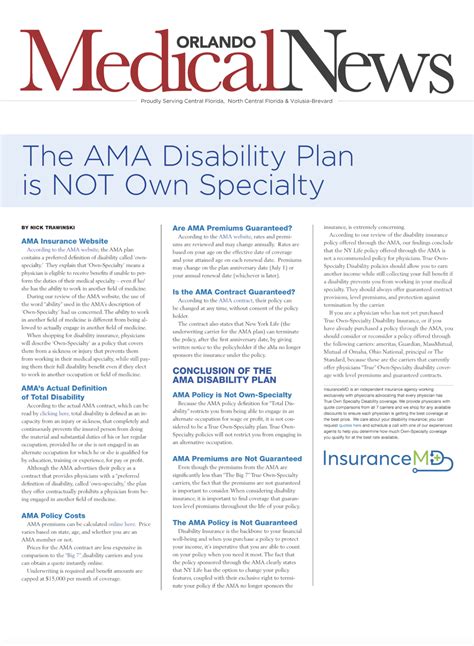

The AMA disability insurance offers several benefits to its members, including: * Income replacement: The insurance provides a monthly benefit to replace a portion of the physician’s income, helping them maintain their standard of living. * Flexibility: The insurance allows physicians to choose from different riders and options to tailor their coverage to their specific needs. * Portability: The insurance is portable, meaning that physicians can take it with them if they change jobs or locations. * Tax-free benefits: The benefits received from the insurance are tax-free, providing physicians with more money to support themselves and their families.

How AMA Disability Insurance Works

The AMA disability insurance works by providing a monthly benefit to physicians who are unable to work due to illness or injury. The insurance typically covers a percentage of the physician’s income, up to a maximum amount. The benefit amount and duration of coverage vary depending on the specific policy and the physician’s needs. To be eligible for benefits, physicians must meet the insurance company’s definition of disability, which typically includes: * Own-occupation: The physician is unable to perform the duties of their own occupation. * Any-occupation: The physician is unable to perform the duties of any occupation for which they are trained or educated.

Types of AMA Disability Insurance

The AMA offers several types of disability insurance to its members, including: * Short-term disability insurance: Provides benefits for a short period, typically up to two years. * Long-term disability insurance: Provides benefits for an extended period, typically up to age 65 or lifetime. * Group disability insurance: Provides benefits to a group of physicians, often at a lower cost than individual policies. * Individual disability insurance: Provides benefits to individual physicians, often with more comprehensive coverage than group policies.

Eligibility and Application Process

To be eligible for AMA disability insurance, physicians must meet certain requirements, including: * AMA membership: Physicians must be members of the American Medical Association. * Age and health: Physicians must be under a certain age and meet certain health requirements. * Income: Physicians must have a minimum income to qualify for coverage. The application process typically involves: * Completing an application: Physicians must complete an application, providing personal and medical information. * Underwriting: The insurance company reviews the application and determines the physician’s eligibility and premium rate. * Policy issuance: If approved, the insurance company issues a policy, outlining the terms and conditions of coverage.

Cost of AMA Disability Insurance

The cost of AMA disability insurance varies depending on several factors, including: * Age: Older physicians typically pay higher premiums. * Health: Physicians with pre-existing medical conditions may pay higher premiums. * Income: Physicians with higher incomes may pay higher premiums. * Benefit amount and duration: Physicians who choose higher benefit amounts and longer durations of coverage may pay higher premiums. The cost of coverage can be significant, but it is essential for physicians to protect their income and financial well-being.

| Age | Monthly Premium |

|---|---|

| 30-39 | $200-$500 |

| 40-49 | $300-$700 |

| 50-59 | $500-$1,000 |

💡 Note: The premium rates listed in the table are approximate and may vary depending on individual circumstances.

Conclusion and Final Thoughts

In conclusion, AMA disability insurance provides essential financial protection to physicians in the event of illness or injury. With its flexible coverage options, portability, and tax-free benefits, it is an attractive option for physicians looking to secure their income and financial well-being. While the cost of coverage can be significant, it is a necessary investment for physicians to protect their livelihoods. By understanding the benefits, types, and application process of AMA disability insurance, physicians can make informed decisions about their coverage and ensure a secure financial future.

What is the purpose of AMA disability insurance?

+The purpose of AMA disability insurance is to provide financial protection to physicians in the event of illness or injury that prevents them from working.

How do I apply for AMA disability insurance?

+To apply for AMA disability insurance, you must complete an application, providing personal and medical information, and undergo underwriting to determine your eligibility and premium rate.

What factors affect the cost of AMA disability insurance?

+The cost of AMA disability insurance is affected by factors such as age, health, income, benefit amount, and duration of coverage.