Army Repay Student Loans

Introduction to Army Repayment of Student Loans

The Army offers several programs to help soldiers repay their student loans, making it an attractive career option for those with significant student debt. Student loan repayment is a major concern for many young people, and the Army’s programs can provide substantial relief. In this article, we will explore the different options available for Army personnel to repay their student loans.

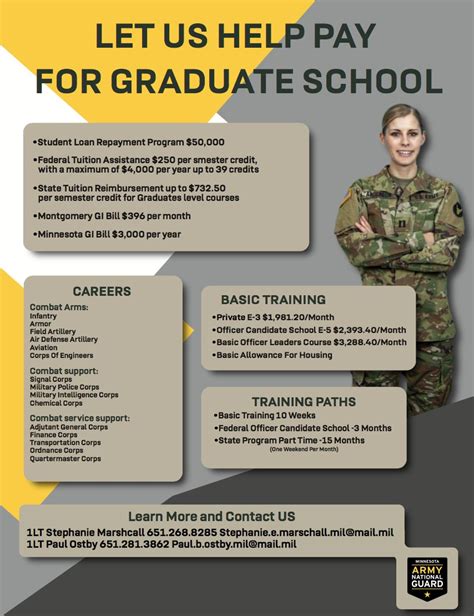

Army Student Loan Repayment Program (SLRP)

The Army Student Loan Repayment Program (SLRP) is a popular option for soldiers to repay their student loans. This program provides up to $65,000 in loan repayment benefits for eligible soldiers. To qualify for the SLRP, soldiers must: * Enlist in the Army for a minimum of three years * Have a high school diploma or equivalent * Score at least 50 on the Armed Services Vocational Aptitude Battery (ASVAB) test * Be willing to serve in a military occupational specialty (MOS) that is eligible for the SLRP

The SLRP pays off a portion of the soldier’s student loans each year, up to a maximum of $65,000 over the course of their enlistment. The payment amount is based on the soldier’s loan balance and the number of years they have served.

College Loan Repayment Program (CLRP)

The College Loan Repayment Program (CLRP) is another option for Army personnel to repay their student loans. This program provides up to 50,000 in loan repayment benefits for eligible soldiers. To qualify for the CLRP, soldiers must: * Be a commissioned officer or warrant officer * Have a bachelor's degree or higher * Be serving in a critical skill or shortage area * Have a student loan balance of at least 10,000

The CLRP pays off a portion of the soldier’s student loans each year, up to a maximum of $50,000 over the course of their service.

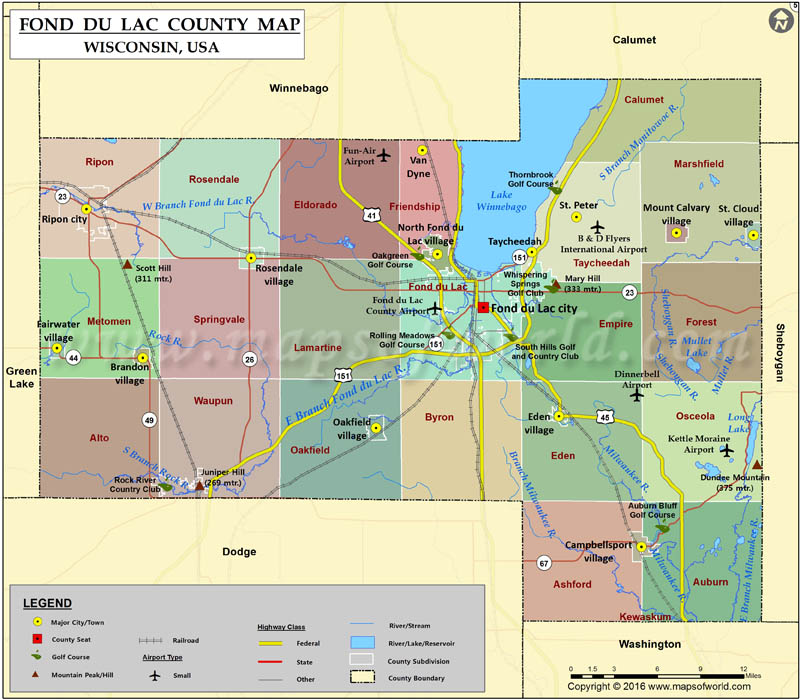

National Guard Student Loan Repayment Program

The National Guard also offers a student loan repayment program for its members. This program provides up to 50,000 in loan repayment benefits for eligible soldiers. To qualify for the National Guard Student Loan Repayment Program, soldiers must: * Be a member of the National Guard * Have a student loan balance of at least 1,000 * Be willing to serve in the National Guard for a minimum of six years

The National Guard Student Loan Repayment Program pays off a portion of the soldier’s student loans each year, up to a maximum of $50,000 over the course of their service.

📝 Note: The eligibility criteria and benefit amounts for these programs may vary depending on the soldier's individual circumstances and the needs of the Army.

How to Apply for Army Student Loan Repayment Programs

To apply for an Army student loan repayment program, soldiers must: * Meet the eligibility criteria for the program * Complete the application process, which typically includes submitting documentation and taking a counseling course * Be accepted into the program by the Army

Soldiers can apply for these programs through their Army recruiter or career counselor. It’s essential to review the eligibility criteria and application process carefully to ensure that you are eligible for the program and to maximize your chances of being accepted.

| Program | Benefit Amount | Eligibility Criteria |

|---|---|---|

| SLRP | Up to $65,000 | Enlist in the Army for a minimum of three years, have a high school diploma or equivalent, score at least 50 on the ASVAB test |

| CLRP | Up to $50,000 | Be a commissioned officer or warrant officer, have a bachelor's degree or higher, be serving in a critical skill or shortage area |

| National Guard Student Loan Repayment Program | Up to $50,000 | Be a member of the National Guard, have a student loan balance of at least $1,000, be willing to serve in the National Guard for a minimum of six years |

Benefits of Army Student Loan Repayment Programs

The Army’s student loan repayment programs offer several benefits, including: * Substantial loan forgiveness: The Army’s programs can provide up to $65,000 in loan forgiveness, which can be a significant reduction in debt for many soldiers. * Reduced financial stress: By repaying a portion of their student loans each year, soldiers can reduce their financial stress and focus on their military career. * Increased career opportunities: The Army’s programs can provide soldiers with the opportunity to pursue careers that they may not have been able to afford otherwise. * Improved quality of life: By reducing their debt burden, soldiers can improve their overall quality of life and achieve greater financial stability.

In summary, the Army’s student loan repayment programs can provide substantial benefits for soldiers who are struggling with student loan debt. By understanding the eligibility criteria and application process for these programs, soldiers can take advantage of these benefits and achieve greater financial stability.

The Army’s student loan repayment programs are just one of the many benefits that the Army offers to its soldiers. By combining these programs with other benefits, such as education assistance and health insurance, soldiers can achieve greater financial stability and improve their overall quality of life.

In final thoughts, the Army’s student loan repayment programs are an attractive option for those who are looking to repay their student loans while serving their country. These programs can provide substantial loan forgiveness and reduce financial stress, allowing soldiers to focus on their military career and achieve greater financial stability.

What is the Army Student Loan Repayment Program (SLRP)?

+

The Army Student Loan Repayment Program (SLRP) is a program that provides up to $65,000 in loan repayment benefits for eligible soldiers.

How do I apply for the SLRP?

+

To apply for the SLRP, soldiers must meet the eligibility criteria, complete the application process, and be accepted into the program by the Army.

What are the benefits of the Army’s student loan repayment programs?

+

The Army’s student loan repayment programs offer several benefits, including substantial loan forgiveness, reduced financial stress, increased career opportunities, and improved quality of life.