Cottage Food Insurance

Introduction to Cottage Food Insurance

For individuals who operate a cottage food business, having the right insurance coverage is crucial. Cottage food insurance provides protection against various risks, including liability, property damage, and business interruption. In this article, we will delve into the world of cottage food insurance, exploring its importance, types, and benefits.

What is Cottage Food Insurance?

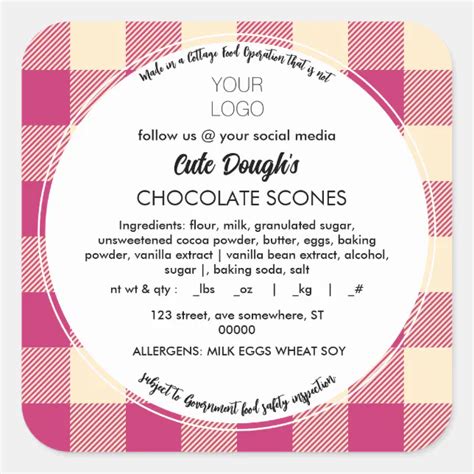

Cottage food insurance is a type of insurance designed specifically for cottage food operators. These businesses are typically small, home-based operations that produce and sell low-risk foods, such as baked goods, jams, and honey. Cottage food laws vary from state to state, but most require cottage food operators to obtain insurance to protect themselves and their customers.

Types of Cottage Food Insurance

There are several types of insurance that cottage food operators may need, including: * Liability insurance: This type of insurance protects against claims of bodily injury or property damage caused by the business’s products or operations. * Property insurance: This type of insurance covers damage to the business’s property, including equipment and inventory. * Business interruption insurance: This type of insurance provides financial support in the event that the business is forced to close due to unforeseen circumstances, such as a natural disaster or equipment failure. * Product liability insurance: This type of insurance protects against claims related to the safety and quality of the business’s products.

Benefits of Cottage Food Insurance

Having cottage food insurance can provide numerous benefits, including: * Protection against financial loss: Insurance can help protect the business against financial losses due to liability claims, property damage, or business interruption. * Compliance with regulations: Many states require cottage food operators to have insurance, so having a policy can help ensure compliance with regulations. * Increased credibility: Having insurance can increase the business’s credibility and reputation, making it more attractive to customers and partners. * Peace of mind: Knowing that the business is protected against various risks can provide peace of mind and reduce stress.

How to Choose the Right Cottage Food Insurance

Choosing the right cottage food insurance policy can be challenging, but there are several factors to consider, including: * Premium costs: The cost of premiums will vary depending on the type and amount of coverage, as well as the business’s location and size. * Coverage limits: The policy should provide adequate coverage limits to protect the business against potential losses. * Deductible amounts: The deductible amount is the amount that the business must pay out of pocket before the insurance kicks in. * Provider reputation: It’s essential to choose an insurance provider with a good reputation and excellent customer service.

📝 Note: When selecting a cottage food insurance policy, it's crucial to carefully review the policy terms and conditions to ensure that it meets the business's specific needs.

Cottage Food Insurance Providers

There are several insurance providers that offer cottage food insurance policies, including: * State Farm * Allstate * Liberty Mutual * USAA * Farmers Insurance

| Provider | Premium Costs | Coverage Limits | Deductible Amounts |

|---|---|---|---|

| State Farm | $200-$500 per year | $100,000-$500,000 | $500-$1,000 |

| Allstate | $300-$700 per year | $200,000-$1,000,000 | $1,000-$2,000 |

| Liberty Mutual | $400-$1,000 per year | $300,000-$1,500,000 | $1,500-$3,000 |

Conclusion

In conclusion, cottage food insurance is a vital component of any cottage food business. By understanding the types of insurance available, the benefits of having insurance, and how to choose the right policy, cottage food operators can protect themselves and their businesses against various risks. With the right insurance coverage, cottage food operators can focus on what they do best – producing delicious, high-quality foods for their customers.

What is cottage food insurance?

+Cottage food insurance is a type of insurance designed specifically for cottage food operators, providing protection against various risks, including liability, property damage, and business interruption.

Do I need cottage food insurance?

+Yes, many states require cottage food operators to have insurance to protect themselves and their customers. Even if it’s not required, having insurance can provide peace of mind and protect the business against financial losses.

How much does cottage food insurance cost?

+The cost of cottage food insurance varies depending on the type and amount of coverage, as well as the business’s location and size. Premiums can range from 200 to 1,000 per year or more.