Design The Ultimate U Of U Tuition Plan: A Pro's Guide

Introduction

Designing an effective tuition plan is crucial for students aiming to pursue their academic goals while managing financial responsibilities. With the rising costs of education, it is essential to develop a well-thought-out strategy to navigate the complex world of tuition payments. In this guide, we will explore the key steps and considerations to create the ultimate U of U tuition plan, ensuring a smooth and stress-free educational journey.

Step 1: Understand Your Financial Aid Options

Before diving into your tuition plan, it is vital to explore the available financial aid opportunities. The University of U offers a range of scholarships, grants, and work-study programs to support students’ education. Take the time to research and understand the following:

- Scholarships: Look for merit-based and need-based scholarships offered by the university. These can significantly reduce your tuition burden.

- Grants: Explore federal and state grants, as well as institutional grants provided by the University of U. Grants often do not require repayment, making them an excellent financial aid option.

- Work-Study Programs: Consider participating in work-study programs, which allow you to earn money while gaining valuable work experience on campus.

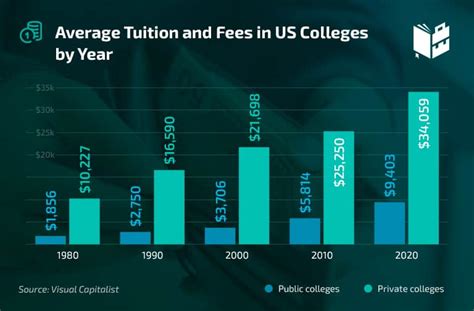

Step 2: Assess Your Tuition Costs

Understanding your tuition costs is fundamental to creating a realistic plan. The University of U’s tuition fees can vary based on factors such as your program, year of study, and residency status. Break down your tuition expenses into the following categories:

- Tuition Fees: Determine the cost of your specific program and the number of credits you plan to take each semester.

- Mandatory Fees: Consider additional mandatory fees, such as student activity fees, health services fees, and technology fees.

- Housing and Dining: If you plan to live on campus, factor in the costs of accommodation and dining plans.

- Books and Supplies: Estimate the expenses for textbooks, course materials, and any other necessary supplies.

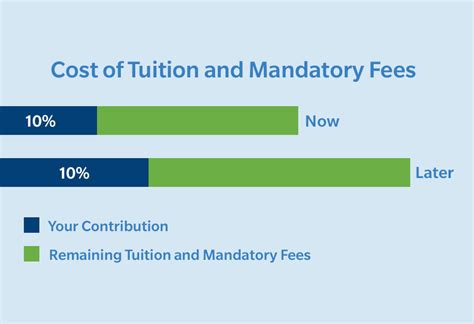

Step 3: Explore Payment Plans

The University of U offers various payment plans to assist students in managing their tuition expenses. Familiarize yourself with the available options:

- Semester Payment Plan: This plan allows you to pay your tuition fees in installments over the course of the semester. It provides flexibility and helps spread out the financial burden.

- Monthly Payment Plan: If you prefer smaller, more frequent payments, the monthly plan enables you to pay your tuition in monthly installments.

- Interest-Free Payment Plans: Some universities offer interest-free payment plans, which allow you to pay your tuition over an extended period without incurring additional interest charges.

Step 4: Consider External Funding Sources

In addition to financial aid and payment plans, explore external funding sources to further reduce your tuition costs:

- Personal Savings: If you have saved money specifically for your education, utilize these funds to cover a portion of your tuition expenses.

- Family Contributions: Discuss with your family members the possibility of contributing to your education. Many families support their loved ones’ pursuit of higher education.

- Education Loans: Research and compare education loan options from private lenders or federal loan programs. Ensure you understand the terms and conditions before committing to a loan.

Step 5: Create a Budget and Stick to It

Developing a budget is crucial to managing your finances effectively. Create a detailed budget that accounts for all your expenses, including tuition, living costs, transportation, and personal expenses. Here are some tips for budgeting:

- Track Your Expenses: Keep a record of your spending to identify areas where you can cut back or make adjustments.

- Set Financial Goals: Define short-term and long-term financial goals, such as saving for an emergency fund or paying off student loans early.

- Prioritize Tuition Payments: Ensure that tuition payments are a top priority in your budget. Allocate funds specifically for tuition to avoid any delays or penalties.

Step 6: Stay Informed and Seek Support

Staying informed about financial aid opportunities, payment plans, and any changes in tuition policies is essential. The University of U’s financial aid office and student services can provide valuable guidance and support. Reach out to these resources and take advantage of their expertise:

- Financial Aid Office: Schedule appointments with financial aid advisors to discuss your specific situation and explore additional funding options.

- Student Support Services: Utilize the resources offered by student support services, such as counseling, academic advising, and career development centers. These services can help you navigate any challenges and make informed decisions.

Step 7: Plan for the Future

As you progress through your academic journey, it is important to continuously review and adjust your tuition plan. Here are some key considerations for the future:

- Scholarship Renewal: If you are awarded scholarships, understand the renewal criteria and requirements. Maintain a strong academic performance to ensure continued eligibility.

- Part-Time Work: Consider taking on part-time jobs or internships to supplement your income and reduce the reliance on loans.

- Post-Graduation Repayment: Plan for the repayment of any education loans you may have taken. Research repayment options and strategies to manage your debt effectively.

Conclusion

Designing the ultimate U of U tuition plan requires a comprehensive understanding of your financial aid options, tuition costs, and available payment plans. By following the steps outlined in this guide, you can create a tailored plan that suits your financial situation and ensures a smooth educational experience. Remember to stay organized, seek support when needed, and regularly review and adjust your plan to stay on track. With careful planning and dedication, you can achieve your academic goals while managing your finances responsibly.

FAQ

What are the eligibility criteria for scholarships at the University of U?

+Scholarship eligibility criteria may vary depending on the specific scholarship. Generally, scholarships consider factors such as academic merit, financial need, extracurricular involvement, and community service. It is recommended to research and review the requirements for each scholarship you are interested in.

Can I apply for multiple scholarships simultaneously?

+Yes, you can apply for multiple scholarships simultaneously. However, it is important to carefully review the application requirements and deadlines for each scholarship to ensure you meet all the necessary criteria. Submitting strong and tailored applications for each scholarship increases your chances of success.

Are there any work-study programs available for international students?

+Work-study programs are typically available to both domestic and international students. However, the availability and eligibility criteria may vary. It is advisable to check with the University of U’s financial aid office or international student services to understand the specific requirements and opportunities for international students.

Can I negotiate my tuition fees with the University of U?

+Negotiating tuition fees directly with the University of U is generally not possible. Tuition fees are set by the university and are subject to approval by the relevant authorities. However, you can explore scholarship and financial aid opportunities to reduce your overall tuition costs.

What are the repayment options for education loans offered by the University of U?

+The University of U offers various repayment options for education loans, including standard repayment plans, income-driven repayment plans, and extended repayment plans. It is important to carefully review the terms and conditions of each loan and choose the repayment plan that best suits your financial situation and goals.