Insurance

E & O Insurance For Notary

Understanding the Importance of E & O Insurance for Notaries

As a notary public, you play a crucial role in verifying the authenticity of documents and ensuring that signers are who they claim to be. While your work is essential, it also comes with potential risks, including the possibility of errors or omissions that could lead to financial losses for your clients. This is where Error and Omissions (E & O) insurance comes in – a type of professional liability insurance designed to protect notaries from the financial consequences of mistakes or oversights.

What is E & O Insurance for Notaries?

E & O insurance for notaries is a specialized policy that provides coverage for notaries in the event of an error or omission that results in a financial loss for their clients. This type of insurance is essential for notaries, as it helps to protect them from the potential financial consequences of mistakes, such as incorrectly witnessing a signature or failing to properly verify the identity of a signer. With E & O insurance, notaries can have peace of mind knowing that they are protected in the event of an unexpected mistake.

Benefits of E & O Insurance for Notaries

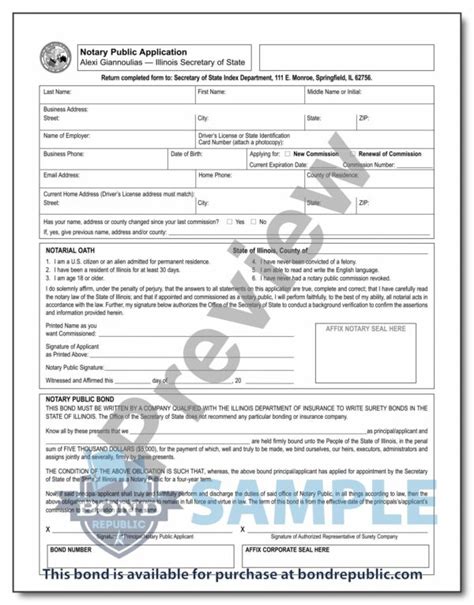

There are several benefits to having E & O insurance as a notary, including: * Financial protection: E & O insurance provides financial protection in the event of an error or omission, helping to prevent financial ruin. * Professional reputation: Having E & O insurance demonstrates a commitment to professionalism and a desire to protect clients, which can help to enhance your reputation as a notary. * Compliance with regulations: In some states, E & O insurance is required for notaries, so having a policy can help to ensure compliance with regulatory requirements. * Peace of mind: With E & O insurance, notaries can have peace of mind knowing that they are protected in the event of an unexpected mistake.

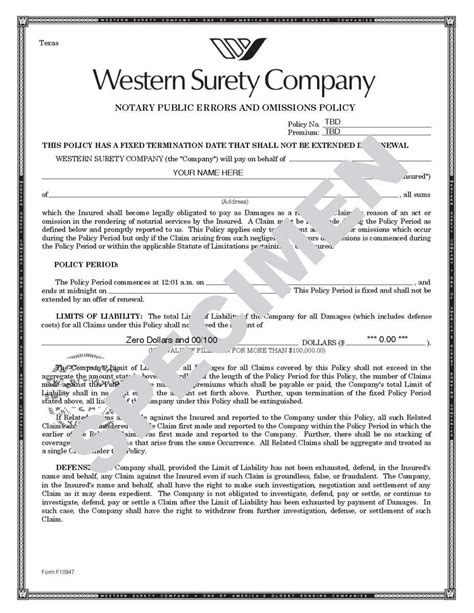

Types of E & O Insurance Policies for Notaries

There are several types of E & O insurance policies available for notaries, including: * Claims-made policies: These policies provide coverage for claims made during the policy period, regardless of when the error or omission occurred. * Occurrence policies: These policies provide coverage for errors or omissions that occur during the policy period, regardless of when the claim is made. * Professional liability policies: These policies provide coverage for a range of professional errors, including errors and omissions.

How to Choose an E & O Insurance Policy for Notaries

When choosing an E & O insurance policy as a notary, there are several factors to consider, including: * Policy limits: Consider the level of coverage you need, based on the types of documents you notarize and the potential financial consequences of an error or omission. * Deductible: Consider the deductible amount, which is the amount you must pay out of pocket before the insurance policy kicks in. * Premium: Consider the premium amount, which is the amount you pay for the insurance policy. * Insurance provider: Consider the reputation and financial stability of the insurance provider.

| Policy Type | Policy Limits | Deductible | Premium |

|---|---|---|---|

| Claims-made policy | $25,000 | $500 | $200 |

| Occurrence policy | $50,000 | $1,000 | $500 |

| Professional liability policy | $100,000 | $2,000 | $1,000 |

📝 Note: The policy limits, deductible, and premium amounts listed in the table are examples only and may vary depending on the insurance provider and policy type.

Conclusion and Final Thoughts

In conclusion, E & O insurance is an essential investment for notaries, providing financial protection and peace of mind in the event of an error or omission. By understanding the importance of E & O insurance and choosing the right policy, notaries can protect themselves and their clients from the potential financial consequences of mistakes. Whether you are a seasoned notary or just starting out, E & O insurance is a vital part of your professional toolkit.

What is the purpose of E & O insurance for notaries?

+The purpose of E & O insurance for notaries is to provide financial protection in the event of an error or omission that results in a financial loss for their clients.

What types of E & O insurance policies are available for notaries?

+There are several types of E & O insurance policies available for notaries, including claims-made policies, occurrence policies, and professional liability policies.

How do I choose an E & O insurance policy as a notary?

+When choosing an E & O insurance policy as a notary, consider factors such as policy limits, deductible, premium, and insurance provider.