Financial Analyst Job

Introduction to Financial Analyst Job

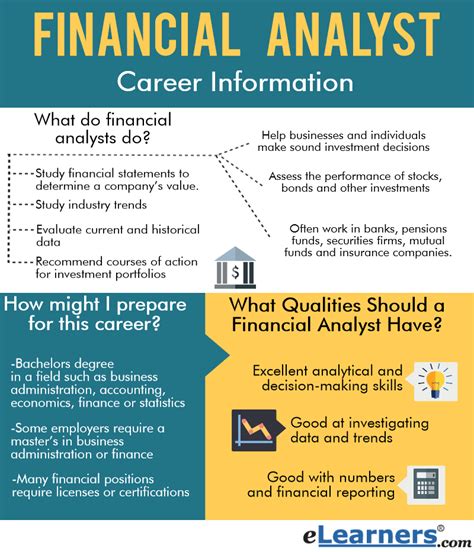

A financial analyst job is a vital role in any organization, responsible for analyzing and interpreting financial data to help businesses and individuals make informed decisions about investments and other financial matters. Financial analysts use their knowledge of finance, accounting, and economics to analyze financial statements, forecast future financial trends, and identify areas for improvement. In this blog post, we will explore the duties and responsibilities of a financial analyst, the skills and qualifications required for the job, and the career path and job prospects for financial analysts.

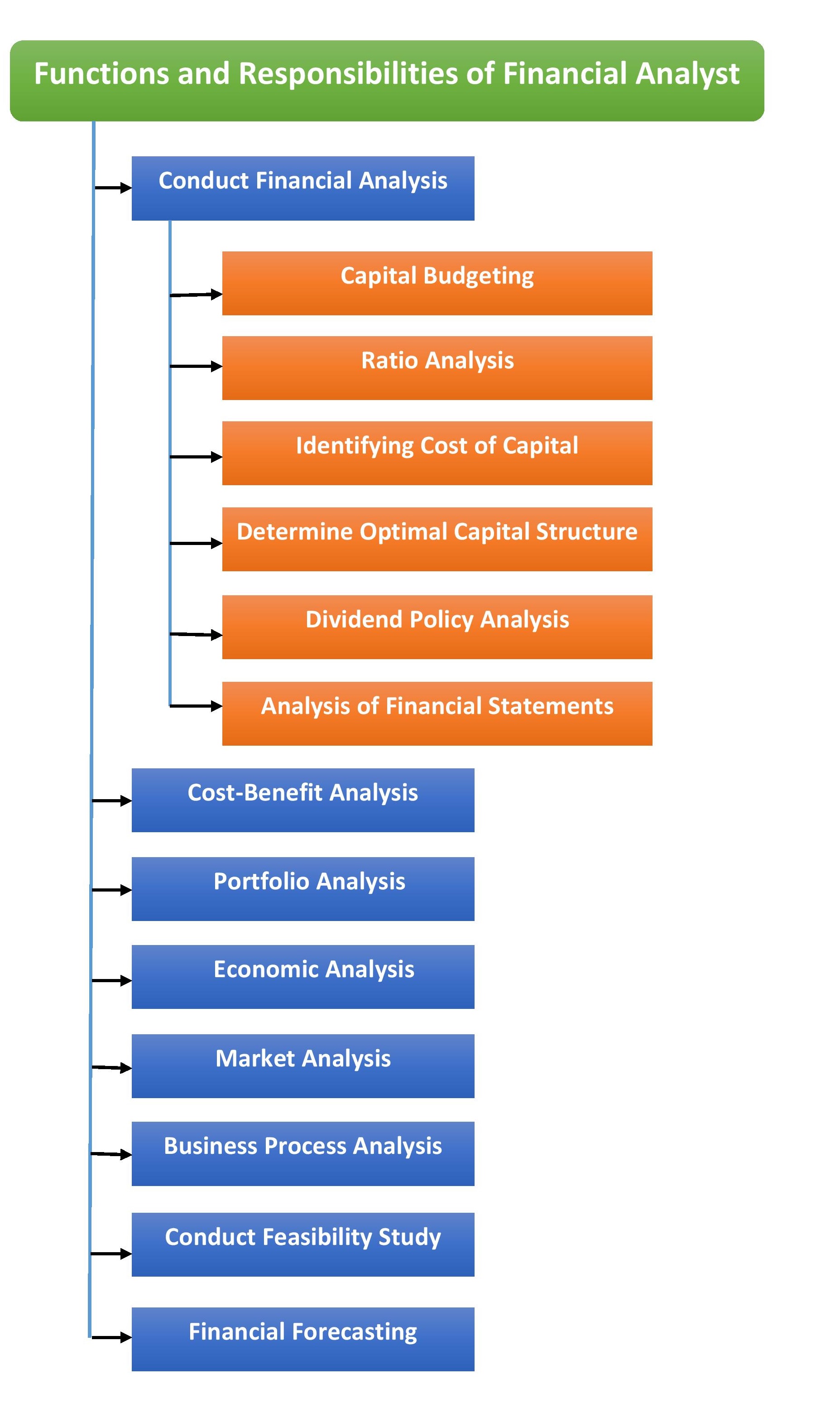

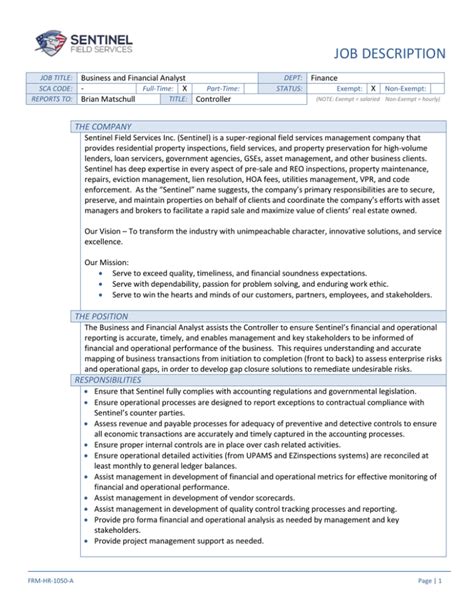

Duties and Responsibilities

The primary duties and responsibilities of a financial analyst include: * Analyzing financial statements and data to identify trends and areas for improvement * Preparing and presenting financial reports and forecasts to management and other stakeholders * Developing and implementing financial models and forecasts to predict future financial trends * Identifying and mitigating financial risks and opportunities * Providing financial guidance and advice to management and other departments * Staying up-to-date with changes in the financial markets and regulatory environment Financial analysts may work in a variety of industries, including finance, accounting, banking, and investment. They may also work in corporate finance, investment banking, or portfolio management.

Skills and Qualifications

To be successful as a financial analyst, one needs to possess certain skills and qualifications, including: * A bachelor’s degree in finance, accounting, or a related field * Strong analytical and problem-solving skills * Excellent communication and presentation skills * Ability to work with financial software and systems, such as Excel and financial modeling tools * Strong attention to detail and organizational skills * Ability to work in a fast-paced environment and meet deadlines * Certification as a Chartered Financial Analyst (CFA) or Certified Financial Manager (CFM) may be advantageous Financial analysts must also stay current with changes in the financial markets and regulatory environment, and be able to adapt to new technologies and systems.

Types of Financial Analysts

There are several types of financial analysts, including: * Corporate financial analysts, who work in-house for a company and provide financial guidance and advice to management * Investment financial analysts, who work for investment banks, asset management companies, or other financial institutions and provide investment advice to clients * Portfolio managers, who manage investment portfolios for individuals or institutions * Risk management specialists, who identify and mitigate financial risks for companies Each type of financial analyst has its own unique responsibilities and requirements, but all require strong analytical and problem-solving skills.

Table of Financial Analyst Types

| Type of Financial Analyst | Responsibilities | Requirements |

|---|---|---|

| Corporate Financial Analyst | Provide financial guidance and advice to management | Bachelor’s degree in finance or accounting, strong analytical skills |

| Investment Financial Analyst | Provide investment advice to clients | Bachelor’s degree in finance or accounting, CFA or CFM certification |

| Portfolio Manager | Manage investment portfolios for individuals or institutions | Bachelor’s degree in finance or accounting, strong analytical and investment skills |

| Risk Management Specialist | Identify and mitigate financial risks for companies | Bachelor’s degree in finance or accounting, strong analytical and problem-solving skills |

💡 Note: The requirements and responsibilities for each type of financial analyst may vary depending on the company and industry.

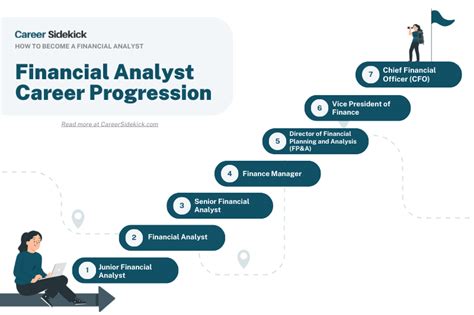

Career Path and Job Prospects

The career path for a financial analyst typically begins with a bachelor’s degree in finance or accounting, followed by several years of experience in a financial analyst role. With experience and certification, financial analysts can move into senior roles, such as portfolio manager or risk management specialist. Job prospects for financial analysts are strong, with the Bureau of Labor Statistics predicting a 6% growth in employment opportunities from 2020 to 2030.

In summary, a financial analyst job is a challenging and rewarding career that requires strong analytical and problem-solving skills, as well as excellent communication and presentation skills. With the right skills and qualifications, financial analysts can enjoy a successful and lucrative career in a variety of industries.

What is the primary responsibility of a financial analyst?

+The primary responsibility of a financial analyst is to analyze and interpret financial data to help businesses and individuals make informed decisions about investments and other financial matters.

What skills are required to be a successful financial analyst?

+To be a successful financial analyst, one needs to possess strong analytical and problem-solving skills, excellent communication and presentation skills, and the ability to work with financial software and systems.

What are the job prospects for financial analysts?

+Job prospects for financial analysts are strong, with the Bureau of Labor Statistics predicting a 6% growth in employment opportunities from 2020 to 2030.

The financial analyst job is a vital role in any organization, and those who possess the right skills and qualifications can enjoy a successful and lucrative career in this field. With the ability to analyze and interpret financial data, financial analysts play a critical role in helping businesses and individuals make informed decisions about investments and other financial matters. As the demand for financial analysts continues to grow, it is an exciting time to pursue a career in this field.