Florida Pay Calculator

Introduction to Florida Pay Calculator

In the state of Florida, calculating pay can be a complex task, especially when considering the various factors that influence an employee’s take-home pay. The Florida pay calculator is a tool designed to simplify this process, providing individuals with an accurate estimate of their net pay based on their gross income, deductions, and other relevant factors. This article will delve into the details of the Florida pay calculator, its components, and how it can be used to calculate pay.

Components of the Florida Pay Calculator

The Florida pay calculator typically includes several components that are essential for calculating an employee’s pay. These components may vary depending on the specific calculator being used, but some of the most common ones include: * Gross income: The total amount of money earned by an employee before any deductions are made. * Federal income tax: The amount of tax withheld from an employee’s paycheck based on their income and filing status. * State income tax: Florida does not have a state income tax, but some calculators may include this field for employees who work in other states. * Local taxes: Some cities or counties in Florida may have local taxes that are withheld from an employee’s paycheck. * Social Security tax: A tax withheld from an employee’s paycheck to fund Social Security and Medicare. * Medicare tax: A tax withheld from an employee’s paycheck to fund Medicare. * Other deductions: This may include deductions for health insurance, retirement plans, and other benefits.

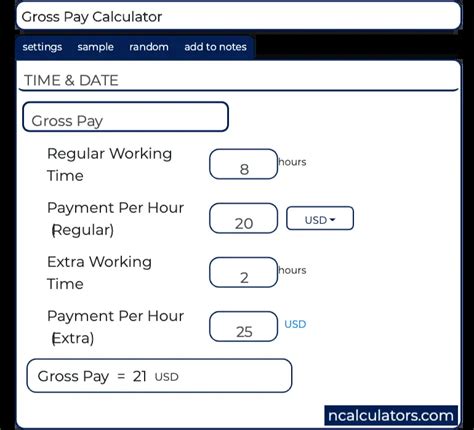

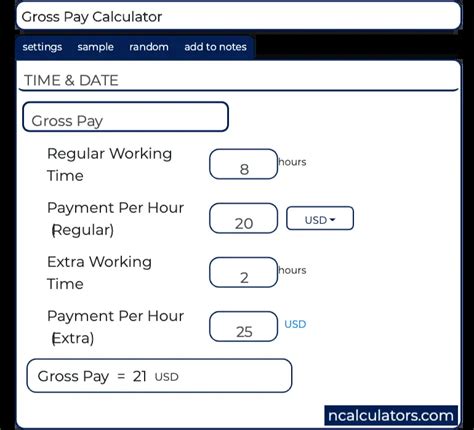

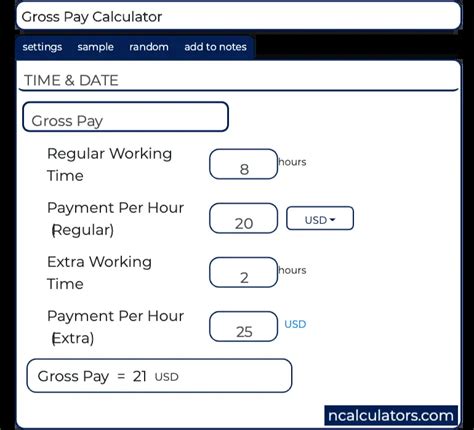

How to Use the Florida Pay Calculator

Using the Florida pay calculator is a straightforward process that requires some basic information about the employee’s income and deductions. Here are the steps to follow: * Enter the employee’s gross income, including any bonuses or commissions. * Select the employee’s filing status, such as single, married, or head of household. * Enter the number of dependents the employee claims. * Enter any deductions the employee is eligible for, such as health insurance or retirement plan contributions. * Enter any local taxes that apply to the employee’s income. * Calculate the employee’s net pay based on the entered information.

💡 Note: The accuracy of the Florida pay calculator depends on the accuracy of the information entered. It is essential to ensure that all information is correct and up-to-date to get an accurate estimate of the employee's net pay.

Benefits of Using the Florida Pay Calculator

The Florida pay calculator offers several benefits to employees and employers alike. Some of the most significant advantages include: * Accurate estimates: The calculator provides an accurate estimate of an employee’s net pay, taking into account various factors that influence their take-home pay. * Convenience: The calculator is easy to use and can be accessed online, making it a convenient tool for employees and employers. * Time-saving: The calculator saves time and effort by automating the calculation process, reducing the likelihood of errors and inaccuracies. * Informed decision-making: The calculator provides employees with a clear understanding of their net pay, enabling them to make informed decisions about their finances and benefits.

Common Pay-Related Terms in Florida

Here are some common pay-related terms that are relevant to the Florida pay calculator: * Gross pay: The total amount of money earned by an employee before any deductions are made. * Net pay: The amount of money an employee takes home after all deductions have been made. * Deductions: Amounts withheld from an employee’s paycheck for taxes, benefits, and other purposes. * Exemptions: Amounts that are exempt from taxation, such as certain types of income or benefits. * Withholding: The process of deducting taxes and other amounts from an employee’s paycheck.

| Term | Definition |

|---|---|

| Gross pay | The total amount of money earned by an employee before any deductions are made. |

| Net pay | The amount of money an employee takes home after all deductions have been made. |

| Deductions | Amounts withheld from an employee's paycheck for taxes, benefits, and other purposes. |

In summary, the Florida pay calculator is a valuable tool for employees and employers in the state of Florida. By understanding how to use the calculator and the components that influence an employee’s net pay, individuals can make informed decisions about their finances and benefits. Whether you are an employee looking to estimate your take-home pay or an employer seeking to provide accurate pay information to your employees, the Florida pay calculator is an essential resource.

What is the Florida pay calculator?

+The Florida pay calculator is a tool designed to estimate an employee’s net pay based on their gross income, deductions, and other relevant factors.

How do I use the Florida pay calculator?

+To use the Florida pay calculator, enter the employee’s gross income, select their filing status, enter the number of dependents, and enter any deductions or local taxes that apply.

What are the benefits of using the Florida pay calculator?

+The benefits of using the Florida pay calculator include accurate estimates, convenience, time-saving, and informed decision-making.