Forethought Life Insurance

Introduction to Forethought Life Insurance

Forethought Life Insurance is a type of insurance policy that provides financial protection to individuals and their loved ones in the event of death or terminal illness. It is an essential part of financial planning, as it helps to ensure that dependents are taken care of and that outstanding debts are paid off. In this article, we will explore the benefits and features of Forethought Life Insurance, as well as the different types of policies available.

Benefits of Forethought Life Insurance

There are several benefits to having a Forethought Life Insurance policy, including: * Financial Protection: A life insurance policy provides a lump sum payment to beneficiaries in the event of the policyholder’s death, which can be used to pay off debts, cover funeral expenses, and provide ongoing financial support. * Peace of Mind: Knowing that loved ones are protected financially can provide peace of mind and reduce stress. * Tax Benefits: The proceeds of a life insurance policy are generally tax-free, which means that beneficiaries will not have to pay taxes on the payout. * Flexibility: Many life insurance policies offer flexible premium payments and coverage options, which can be tailored to individual needs and budgets.

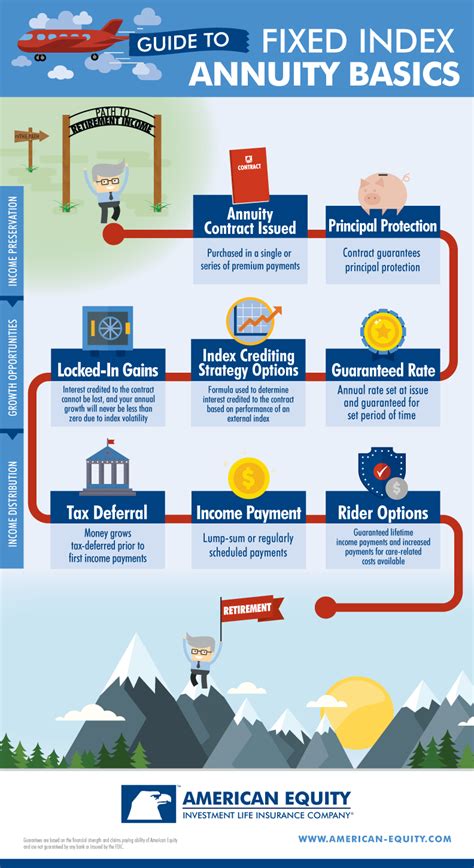

Types of Forethought Life Insurance Policies

There are several types of Forethought Life Insurance policies available, including: * Term Life Insurance: This type of policy provides coverage for a specified period of time (e.g. 10, 20, or 30 years) and pays out a death benefit if the policyholder dies during the term. * Whole Life Insurance: This type of policy provides lifetime coverage and accumulates a cash value over time, which can be borrowed against or used to pay premiums. * Universal Life Insurance: This type of policy combines a death benefit with a savings component, which can earn interest and be used to pay premiums or increase coverage. * Variable Life Insurance: This type of policy allows policyholders to invest their cash value in stocks, bonds, or other investments, which can potentially increase the value of the policy.

How to Choose a Forethought Life Insurance Policy

Choosing the right Forethought Life Insurance policy can be overwhelming, but there are several factors to consider, including: * Age and Health: Policyholders who are younger and healthier may qualify for lower premiums and more comprehensive coverage. * Income and Expenses: Policyholders should consider their income, expenses, and debts when determining how much coverage they need. * Dependents: Policyholders with dependents (e.g. children, spouse) may need more comprehensive coverage to ensure their loved ones are taken care of. * Financial Goals: Policyholders should consider their financial goals, such as paying off a mortgage or funding their children’s education, when choosing a policy.

📝 Note: It's essential to carefully review and understand the terms and conditions of a life insurance policy before purchasing, as well as to consult with a licensed insurance professional to determine the best policy for individual needs and circumstances.

Comparison of Forethought Life Insurance Policies

The following table compares the features and benefits of different Forethought Life Insurance policies:

| Policy Type | Term Length | Death Benefit | Cash Value |

|---|---|---|---|

| Term Life Insurance | 10, 20, or 30 years | Pays out death benefit if policyholder dies during term | No cash value |

| Whole Life Insurance | Lifetime coverage | Pays out death benefit plus cash value | Accumulates cash value over time |

| Universal Life Insurance | Lifetime coverage | Pays out death benefit plus cash value | Combines death benefit with savings component |

| Variable Life Insurance | Lifetime coverage | Pays out death benefit plus cash value | Allows policyholders to invest cash value in stocks, bonds, or other investments |

In summary, Forethought Life Insurance provides financial protection and peace of mind for individuals and their loved ones. With various types of policies available, it’s essential to carefully review and understand the terms and conditions of each policy to determine the best fit for individual needs and circumstances. By considering factors such as age, health, income, expenses, dependents, and financial goals, policyholders can make an informed decision and choose the right Forethought Life Insurance policy for their unique situation.

What is Forethought Life Insurance?

+

Forethought Life Insurance is a type of insurance policy that provides financial protection to individuals and their loved ones in the event of death or terminal illness.

What are the benefits of Forethought Life Insurance?

+

The benefits of Forethought Life Insurance include financial protection, peace of mind, tax benefits, and flexibility.

What types of Forethought Life Insurance policies are available?

+

There are several types of Forethought Life Insurance policies available, including term life insurance, whole life insurance, universal life insurance, and variable life insurance.