Idaho Income Tax Calculator

Introduction to Idaho Income Tax

Idaho, known as the Gem State, is a popular destination for individuals and families alike, offering a mix of urban and rural lifestyles. When it comes to income tax, Idaho has a progressive tax system, meaning the more you earn, the higher the tax rate you’ll pay. The state income tax rates range from 1% to 6.925%, and there are seven tax brackets in total. Understanding how Idaho income tax works and using an Idaho income tax calculator can help you navigate the tax landscape more efficiently.

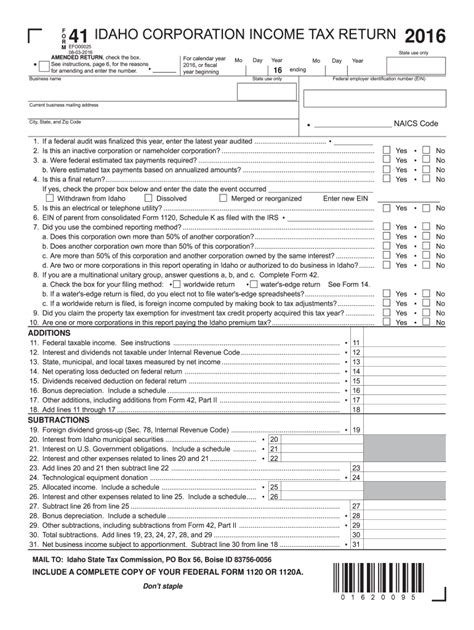

How Idaho Income Tax Works

To calculate your Idaho income tax, you’ll first need to determine your taxable income, which is your gross income minus any deductible expenses and exemptions. Idaho allows taxpayers to itemize deductions or take the standard deduction, similar to the federal income tax system. The state also offers various tax credits that can reduce your tax liability.

Idaho Tax Brackets

The tax brackets in Idaho are adjusted annually for inflation. For the latest tax year, the brackets are as follows:

| Taxable Income | Tax Rate |

|---|---|

| 0 to 1,172 | 1% |

| 1,173 to 2,344 | 2% |

| 2,345 to 3,516 | 3% |

| 3,517 to 5,082 | 4% |

| 5,083 to 7,612 | 5% |

| 7,613 to 11,760 | 6% |

| $11,761 and above | 6.925% |

These brackets are subject to change, so it’s essential to check the latest information when filing your taxes.

Using an Idaho Income Tax Calculator

An Idaho income tax calculator is a useful tool for estimating your state income tax liability. These calculators take into account your income, filing status, and other factors to provide an estimate of your taxes. They can be especially helpful for:

- Planning purposes: To get an idea of how much you’ll owe in taxes for the year, helping you plan your finances more effectively.

- Comparing scenarios: If you’re considering a job change, moving, or other significant life events, an Idaho income tax calculator can help you understand the potential tax implications.

- Estimating tax refunds or payments: Knowing whether you’ll receive a refund or need to make a payment can help you budget accordingly.

- Your gross income from all sources

- Your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er))

- Number of dependents you’re claiming

- Any deductible expenses or tax credits you’re eligible for

📝 Note: While an Idaho income tax calculator is a valuable tool, it's essential to consult the official Idaho State Tax Commission website or a tax professional for the most accurate and up-to-date information regarding your specific tax situation.

Additional Tax Considerations in Idaho

Beyond the state income tax, Idaho residents should also be aware of other taxes that may apply, including:

- Property taxes: These vary by county and are used to fund local government services and schools.

- Sales tax: Idaho has a statewide sales tax rate of 6%, with some local jurisdictions adding additional taxes.

To summarize the key points, Idaho’s income tax system is designed to be progressive, with rates increasing as income rises. The state offers various deductions and credits to help reduce tax liability. Using an Idaho income tax calculator can provide valuable insights into your tax situation, but it’s crucial to stay informed about the latest tax laws and regulations. By being aware of these factors, you can better manage your finances and plan for the future.

What are the income tax rates in Idaho?

+

Idaho’s income tax rates range from 1% to 6.925%, with seven tax brackets. The rates and brackets are adjusted annually for inflation.

How do I calculate my Idaho income tax?

+

To calculate your Idaho income tax, you’ll need to determine your taxable income, which is your gross income minus any deductible expenses and exemptions. Then, use the state’s tax brackets to find your tax rate.

What is an Idaho income tax calculator, and how can it help me?

+

An Idaho income tax calculator is a tool that helps estimate your state income tax liability. It takes into account your income, filing status, and other factors to provide an estimate of your taxes, which can be useful for planning purposes, comparing scenarios, and estimating tax refunds or payments.