Intrepid Direct Insurance

Introduction to Intrepid Direct Insurance

In the vast and complex world of insurance, Intrepid Direct Insurance stands out as a beacon of innovation and customer-centric approach. By directly connecting with clients and eliminating intermediaries, this insurance model promises a more streamlined, cost-effective, and personalized experience. For those navigating the intricate landscape of insurance options, understanding the nuances of Intrepid Direct Insurance can be both enlightening and empowering.

Understanding Intrepid Direct Insurance

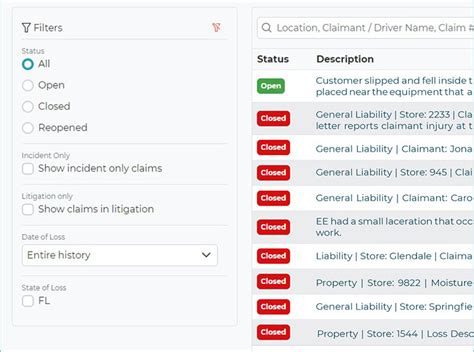

At its core, Intrepid Direct Insurance operates on the principle of selling insurance policies directly to consumers, bypassing traditional agents and brokers. This direct-to-consumer approach is facilitated by advanced digital platforms, allowing for real-time quotes, policy purchases, and claims management. The key benefits of this model include: - Reduced Costs: By eliminating agent commissions, companies can offer policies at lower premiums. - Increased Efficiency: Automated processes and digital tools enable faster policy issuance and claim settlements. - Personalized Experience: Advanced data analytics and AI-driven systems help in tailoring policies to individual needs.

Key Features of Intrepid Direct Insurance

The appeal of Intrepid Direct Insurance lies in its flexibility and transparency. Some of the notable features include: - Customizable Policies: Allowing clients to choose the coverage they need, rather than paying for a one-size-fits-all policy. - Real-Time Support: Offering 24⁄7 customer support through various channels, including chatbots, phone, and email. - Digital Tools: Providing apps and online platforms for easy policy management and claims filing.

Benefits for Consumers

The direct insurance model brings several benefits to consumers, including: - Lower Premiums: Without agent fees, policies can be more affordable. - Convenience: The ability to manage policies and file claims online, at any time, enhances user experience. - Clear Communication: Direct interaction with the insurer can reduce misunderstandings and improve overall satisfaction.

Challenges and Considerations

While Intrepid Direct Insurance offers numerous advantages, it also presents some challenges: - Complexity of Choices: Without the guidance of an agent, consumers must navigate policy options independently. - Technical Issues: Dependence on digital platforms can lead to frustration if systems are not user-friendly or experience downtime. - Lack of Personal Touch: Some consumers may miss the personal interaction and advice provided by traditional agents.

Future of Intrepid Direct Insurance

As technology continues to evolve and consumers become more comfortable with digital transactions, the demand for direct insurance is likely to grow. Innovation and adaptability will be key for insurers looking to thrive in this market. Incorporating emerging technologies like blockchain for enhanced security and AI for more personalized services can further differentiate Intrepid Direct Insurance providers.

💡 Note: The success of Intrepid Direct Insurance heavily relies on the insurer's ability to provide clear, understandable information and support to their clients, compensating for the lack of personal interaction.

Comparing Intrepid Direct Insurance to Traditional Models

The choice between Intrepid Direct Insurance and traditional insurance models depends on individual preferences and needs. A comparison of the two can be summarized in the following table:

| Feature | Intrepid Direct Insurance | Traditional Insurance |

|---|---|---|

| Premium Costs | Tend to be lower | Can be higher due to agent fees |

| Policy Management | Digital, self-managed | Often managed through an agent |

| Customer Support | 24⁄7, through various digital channels | Personalized, through an agent |

In essence, the decision to opt for Intrepid Direct Insurance should be based on a thorough understanding of one’s insurance needs, comfort level with digital platforms, and the value placed on personal service versus cost savings.

To summarize, Intrepid Direct Insurance offers a modern, efficient, and potentially cost-effective alternative to traditional insurance models. By understanding its features, benefits, and challenges, consumers can make informed decisions that best meet their insurance needs. The future of insurance is undoubtedly digital, and Intrepid Direct Insurance is at the forefront of this revolution, promising a more direct, transparent, and personalized experience for those who embrace it.

What is Intrepid Direct Insurance?

+Intrepid Direct Insurance refers to the model of selling insurance policies directly to consumers, bypassing traditional agents and brokers, often through digital platforms.

What are the benefits of Intrepid Direct Insurance?

+The benefits include lower premiums due to the elimination of agent commissions, increased efficiency in policy issuance and claims settlement, and a personalized experience through advanced data analytics.

How does Intrepid Direct Insurance handle customer support?

+Intrepid Direct Insurance typically offers 24⁄7 customer support through various digital channels, including chatbots, phone, and email, ensuring that consumers can get help whenever they need it.