Michigan Pay Calculator

Introduction to Michigan Pay Calculator

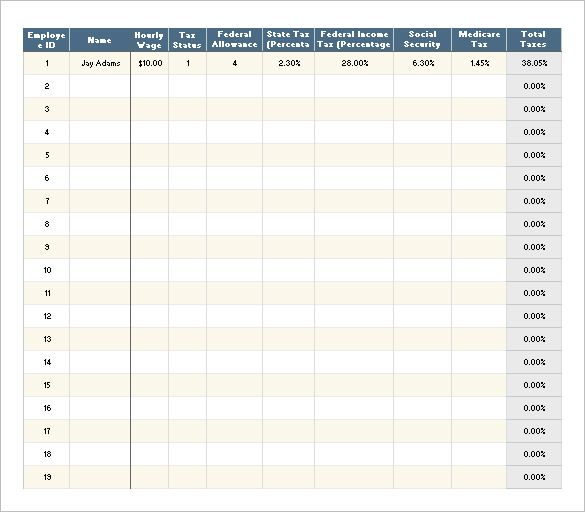

The Michigan pay calculator is a useful tool for employees and employers in the state of Michigan to calculate the correct amount of wages, taxes, and other deductions. It takes into account the state’s specific tax laws and regulations to provide an accurate calculation of take-home pay. In this article, we will discuss the features and benefits of the Michigan pay calculator, as well as provide a step-by-step guide on how to use it.

Features of Michigan Pay Calculator

The Michigan pay calculator has several features that make it a valuable tool for calculating pay. Some of the key features include: * Gross-to-Net Calculation: The calculator can calculate the net pay based on the gross pay, taking into account federal and state taxes, as well as other deductions. * Tax Calculation: The calculator can calculate the amount of federal and state taxes withheld from the employee’s pay. * Deductions Calculation: The calculator can calculate the amount of deductions, such as health insurance, 401(k), and other benefits. * Overtime Calculation: The calculator can calculate the amount of overtime pay, taking into account the employee’s regular pay rate and the number of overtime hours worked.

Benefits of Michigan Pay Calculator

The Michigan pay calculator has several benefits for both employees and employers. Some of the key benefits include: * Accuracy: The calculator ensures accurate calculations, reducing the risk of errors and disputes. * Time-Saving: The calculator saves time and effort, as it automates the calculation process. * Compliance: The calculator ensures compliance with state and federal tax laws and regulations. * Transparency: The calculator provides a clear and transparent breakdown of the calculation, making it easier to understand and verify.

How to Use Michigan Pay Calculator

Using the Michigan pay calculator is straightforward and easy. Here are the steps to follow: * Enter the employee’s gross pay, including any bonuses or commissions. * Enter the employee’s tax filing status, number of dependents, and other tax-related information. * Enter the employee’s deductions, such as health insurance, 401(k), and other benefits. * Enter the employee’s overtime hours worked, if applicable. * Click the “Calculate” button to generate the calculation.

💡 Note: It's essential to ensure that the information entered into the calculator is accurate and up-to-date to ensure accurate calculations.

Tips for Using Michigan Pay Calculator

Here are some tips to keep in mind when using the Michigan pay calculator: * Verify Information: Verify the information entered into the calculator to ensure accuracy. * Update Information: Update the information regularly to reflect changes in tax laws, deductions, and other factors. * Consult Professional: Consult a professional, such as a payroll specialist or accountant, if you’re unsure about any aspect of the calculation.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using the Michigan pay calculator: * Incorrect Tax Filing Status: Entering an incorrect tax filing status can result in inaccurate calculations. * Inaccurate Deductions: Entering inaccurate deductions can result in inaccurate calculations. * Overtime Calculation Errors: Failing to account for overtime hours worked can result in inaccurate calculations.

| Gross Pay | Tax Filing Status | Deductions | Overtime Hours |

|---|---|---|---|

| $50,000 | Single | $5,000 | 10 hours |

| $75,000 | Married | $10,000 | 20 hours |

In summary, the Michigan pay calculator is a valuable tool for calculating pay, taxes, and deductions. By following the steps outlined in this article and avoiding common mistakes, you can ensure accurate calculations and compliance with state and federal tax laws and regulations.

As we finalize our discussion on the Michigan pay calculator, it’s essential to remember that accurate calculations are crucial for both employees and employers. By using the calculator and following the tips outlined in this article, you can ensure that you’re getting the most accurate calculations possible.

What is the Michigan pay calculator?

+The Michigan pay calculator is a tool used to calculate the correct amount of wages, taxes, and other deductions for employees in the state of Michigan.

How do I use the Michigan pay calculator?

+To use the Michigan pay calculator, simply enter the employee’s gross pay, tax filing status, deductions, and overtime hours worked, and click the “Calculate” button to generate the calculation.

What are the benefits of using the Michigan pay calculator?

+The benefits of using the Michigan pay calculator include accuracy, time-saving, compliance with state and federal tax laws and regulations, and transparency.