Montana Paycheck Calculator

Introduction to Montana Paycheck Calculator

Montana paycheck calculator is a tool designed to help individuals calculate their take-home pay after deducting taxes and other factors. Understanding how taxes affect your paycheck is essential for managing your finances effectively. In this article, we will explore the details of the Montana paycheck calculator, including how it works, the factors that affect your take-home pay, and how to use it to your advantage.

How Montana Paycheck Calculator Works

The Montana paycheck calculator takes into account various factors, including gross income, tax filing status, number of dependents, and other deductions. It then applies the relevant tax rates and deductions to calculate the net pay. The calculator uses the following steps to determine the take-home pay: * Calculates the federal income tax based on the gross income and tax filing status * Calculates the state income tax based on the gross income and Montana state tax rates * Applies other deductions, such as health insurance premiums, 401(k) contributions, and other benefits * Calculates the net pay by subtracting the total deductions from the gross income

Factors That Affect Take-Home Pay

Several factors can affect your take-home pay, including: * Gross income: The higher your gross income, the more taxes you will pay * Tax filing status: Your tax filing status, such as single, married, or head of household, can impact your tax rates * Number of dependents: Claiming dependents can reduce your taxable income * Other deductions: Contributions to retirement accounts, health savings accounts, and other benefits can reduce your taxable income * Montana state tax rates: Montana has a progressive tax system, with tax rates ranging from 1% to 6.9%

Using the Montana Paycheck Calculator

Using the Montana paycheck calculator is straightforward. Simply enter your gross income, tax filing status, number of dependents, and other deductions, and the calculator will provide an estimate of your take-home pay. You can use this information to: * Plan your finances: Understand how much money you will take home each month and plan your expenses accordingly * Adjust your withholding: If you find that you are having too much or too little tax withheld, you can adjust your withholding to minimize your tax liability * Make informed decisions: Use the calculator to compare the impact of different scenarios, such as changing your tax filing status or increasing your 401(k) contributions

💡 Note: The Montana paycheck calculator is for estimation purposes only and should not be used as a substitute for professional tax advice.

Benefits of Using the Montana Paycheck Calculator

Using the Montana paycheck calculator can provide several benefits, including: * Accurate estimates: Get an accurate estimate of your take-home pay to plan your finances effectively * Tax planning: Use the calculator to optimize your tax strategy and minimize your tax liability * Financial planning: Make informed decisions about your finances, such as budgeting and saving for retirement

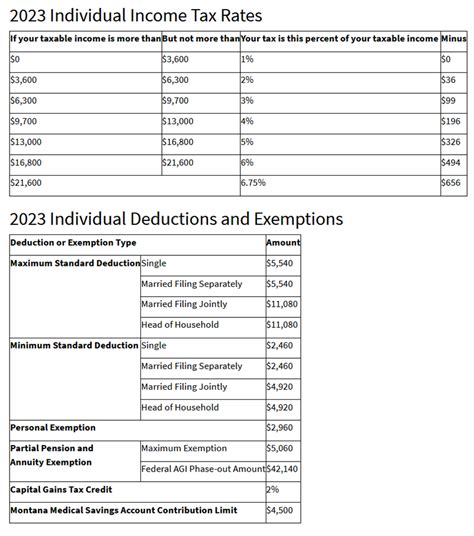

Montana Tax Rates

Montana has a progressive tax system, with tax rates ranging from 1% to 6.9%. The tax rates are as follows:

| Taxable Income | Tax Rate |

|---|---|

| 0 - 3,000 | 1% |

| 3,001 - 5,000 | 2% |

| 5,001 - 8,000 | 3% |

| 8,001 - 11,000 | 4% |

| 11,001 - 14,000 | 5% |

| $14,001 and above | 6.9% |

In summary, the Montana paycheck calculator is a valuable tool for individuals who want to understand how taxes affect their take-home pay. By using the calculator, you can plan your finances effectively, adjust your withholding, and make informed decisions about your tax strategy.

How do I use the Montana paycheck calculator?

+To use the Montana paycheck calculator, simply enter your gross income, tax filing status, number of dependents, and other deductions, and the calculator will provide an estimate of your take-home pay.

What factors affect my take-home pay in Montana?

+Several factors can affect your take-home pay in Montana, including gross income, tax filing status, number of dependents, other deductions, and Montana state tax rates.

How do I adjust my withholding to minimize my tax liability?

+You can adjust your withholding by completing a new W-4 form and submitting it to your employer. You can also use the Montana paycheck calculator to determine the optimal withholding amount for your situation.