Military

Navy Federal Home Equity Loan

Introduction to Navy Federal Home Equity Loan

Navy Federal Credit Union offers a variety of financial products, including home equity loans, to its members. A home equity loan is a type of loan that allows homeowners to borrow money using the equity in their home as collateral. The equity in a home is the difference between the home’s current market value and the outstanding balance on the mortgage. Navy Federal home equity loans can provide a convenient way for homeowners to access cash for various purposes, such as home improvements, debt consolidation, or major purchases.

Benefits of Navy Federal Home Equity Loan

There are several benefits to considering a Navy Federal home equity loan. Some of these benefits include: * Competitive Interest Rates: Navy Federal Credit Union often offers competitive interest rates on home equity loans, which can help keep borrowing costs low. * Flexible Repayment Terms: Members can choose from a range of repayment terms to find one that fits their financial situation and goals. * No Origination Fees: Unlike some other lenders, Navy Federal does not charge origination fees on home equity loans, which can save members money upfront. * Membership Benefits: As a member of Navy Federal Credit Union, borrowers may be eligible for additional benefits, such as discounts on other financial products or services.

Types of Home Equity Loans Offered by Navy Federal

Navy Federal Credit Union offers two main types of home equity loans: * Home Equity Loan: This is a traditional home equity loan, where members borrow a lump sum of money and repay it over a fixed term with a fixed interest rate. * Home Equity Line of Credit (HELOC): A HELOC allows members to borrow and repay funds as needed during a specified draw period, with interest-only payments during that time. After the draw period ends, the loan enters a repayment phase, where members make payments on both the principal and interest.

Eligibility and Application Process

To be eligible for a Navy Federal home equity loan, members must: * Be a member of Navy Federal Credit Union * Own a primary residence, second home, or investment property * Have sufficient equity in the property * Meet credit and income requirements The application process typically involves: * Checking membership eligibility and loan options online or by phone * Applying for the loan and providing required documentation, such as income verification and property information * Receiving a loan decision and, if approved, reviewing and signing the loan documents

Factors to Consider Before Applying

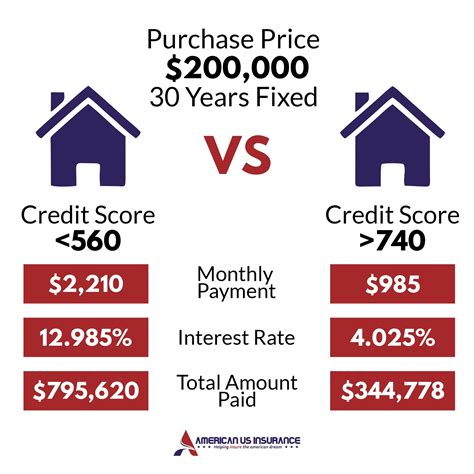

Before applying for a Navy Federal home equity loan, members should consider the following factors: * Interest Rates and Fees: Compare rates and fees with other lenders to ensure the best deal. * Repayment Terms: Choose a repayment term that fits financial goals and budget. * Loan Amount: Borrow only what is needed to avoid over-borrowing and potential financial strain. * Credit Score: A good credit score can help qualify for better interest rates and terms.

💡 Note: It's essential to carefully review the loan terms and conditions before signing any documents to ensure understanding of the agreement.

Using Home Equity Loan Funds

Home equity loan funds can be used for various purposes, such as: * Home improvements or renovations * Debt consolidation * Major purchases, like a car or boat * Education expenses * Emergency funds or unexpected expenses It’s crucial to use the funds responsibly and make timely payments to avoid negatively affecting credit scores or risking foreclosure.

Conclusion

A Navy Federal home equity loan can provide a valuable financial resource for members who need to access cash for various purposes. By understanding the benefits, types of loans, eligibility, and application process, members can make informed decisions about their financial options. It’s essential to carefully consider factors like interest rates, repayment terms, and loan amounts before applying to ensure the best possible outcome.

What are the benefits of a Navy Federal home equity loan?

+The benefits of a Navy Federal home equity loan include competitive interest rates, flexible repayment terms, and no origination fees.

How do I apply for a Navy Federal home equity loan?

+To apply for a Navy Federal home equity loan, members can check their eligibility and loan options online or by phone, then apply and provide required documentation.

What can I use the funds from a Navy Federal home equity loan for?

+The funds from a Navy Federal home equity loan can be used for various purposes, such as home improvements, debt consolidation, major purchases, education expenses, or emergency funds.