New York Paycheck Calculator

New York Paycheck Calculator: Understanding Your Take-Home Pay

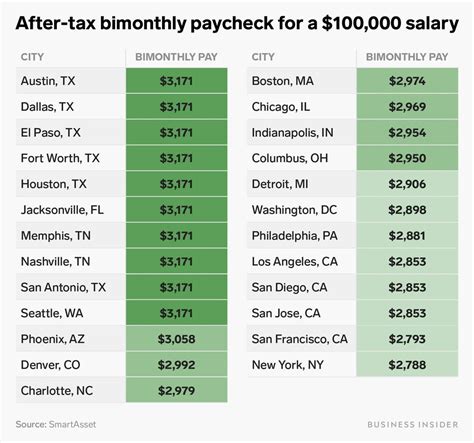

The state of New York is known for its high cost of living, and it’s essential to understand how much of your hard-earned money you get to take home after taxes and other deductions. A New York paycheck calculator can help you estimate your take-home pay, making it easier to budget and plan your finances. In this article, we’ll explore how to use a paycheck calculator, the factors that affect your take-home pay, and provide tips on how to maximize your earnings.

How to Use a New York Paycheck Calculator

Using a New York paycheck calculator is relatively straightforward. You’ll need to provide some basic information, including:

- Your gross income (the amount you earn before taxes and deductions)

- Your filing status (single, married, head of household, etc.)

- The number of dependents you claim

- Your tax withholding status (single, married, etc.)

- Any additional income or deductions you want to include (401(k) contributions, health insurance premiums, etc.)

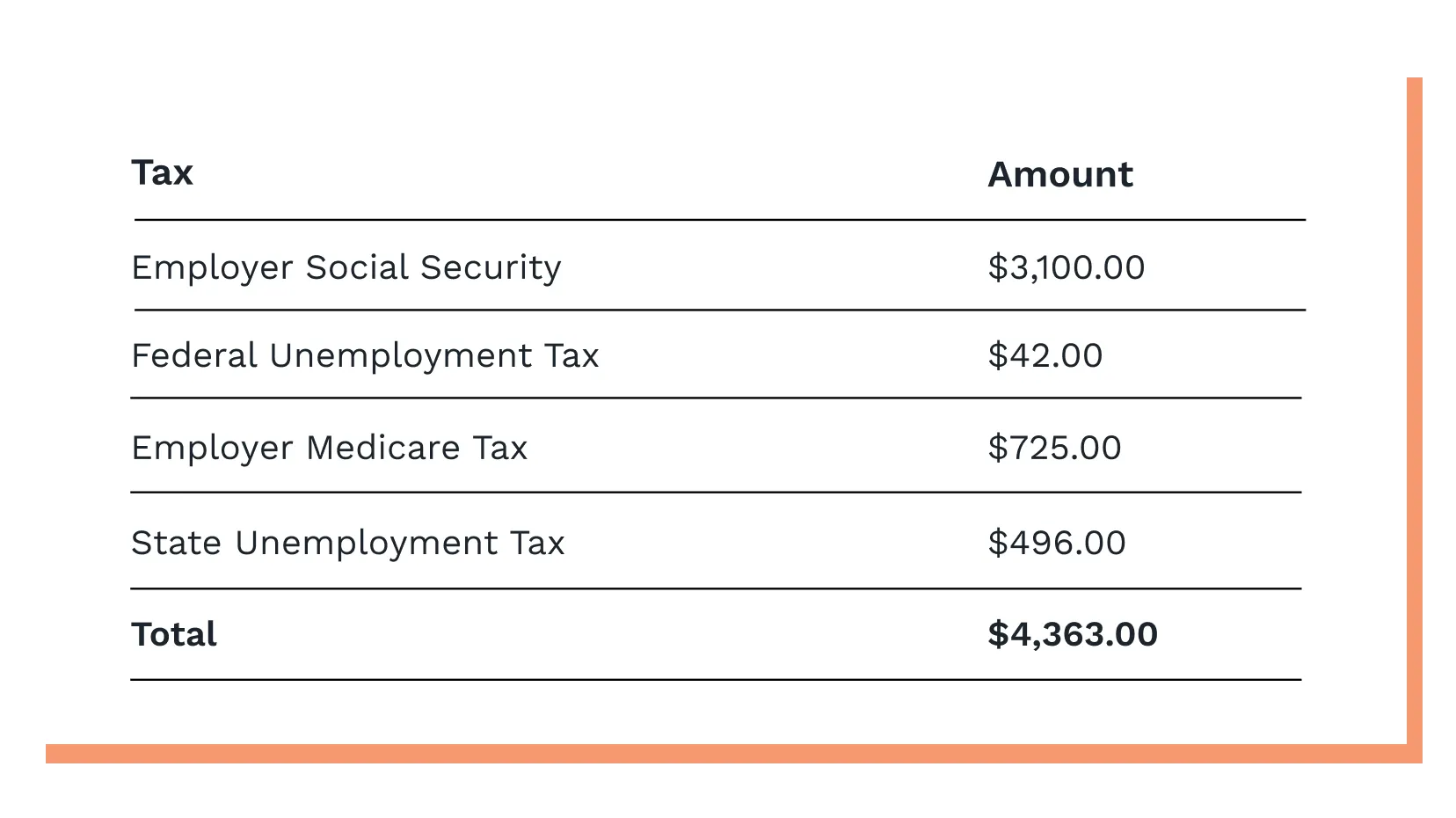

Factors That Affect Your Take-Home Pay

Several factors can affect your take-home pay in New York, including:

- Federal income taxes: The federal government withholds a portion of your income for taxes, which can range from 10% to 37% of your gross income

- New York state income taxes: New York state withholds a portion of your income for state taxes, which can range from 4% to 8.82% of your gross income

- Local taxes: Some cities and counties in New York impose additional taxes on income, which can range from 0% to 3.648% of your gross income

- Other deductions: You may have other deductions taken out of your paycheck, such as health insurance premiums, 401(k) contributions, or union dues

Tips for Maximizing Your Take-Home Pay

Here are some tips for maximizing your take-home pay in New York:

- Take advantage of tax-advantaged retirement accounts: Contributing to a 401(k) or other retirement account can reduce your taxable income and lower your tax liability

- Claim all eligible deductions and credits: Make sure you’re claiming all eligible deductions and credits, such as the earned income tax credit (EITC) or child tax credit

- Negotiate your salary: If possible, negotiate your salary to increase your gross income and take-home pay

- Consider itemizing deductions: If you have significant expenses, such as medical bills or mortgage interest, you may be able to itemize deductions and reduce your tax liability

📝 Note: It's essential to consult with a tax professional or financial advisor to ensure you're taking advantage of all eligible deductions and credits and minimizing your tax liability.

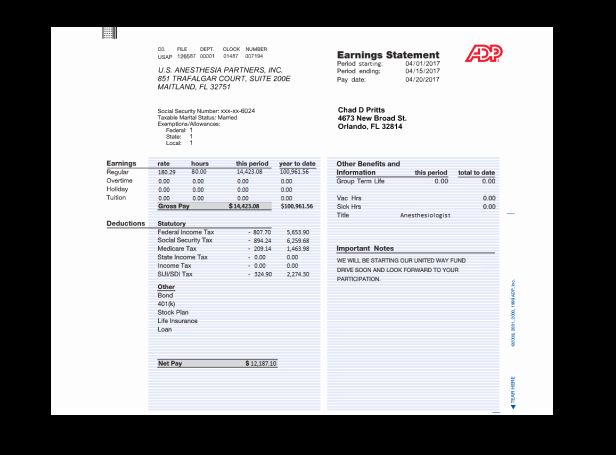

New York Paycheck Calculator Example

Let’s say you’re a single person earning 50,000 per year, with no dependents and a tax withholding status of single. You contribute 10% of your income to a 401(k) and have health insurance premiums deducted from your paycheck. Using a <i>New York paycheck calculator</i>, you estimate your take-home pay to be: <table> <tr> <th>Gross Income</th> <th>Taxes Withheld</th> <th>Other Deductions</th> <th>Take-Home Pay</th> </tr> <tr> <td>50,000 10,000</td> <td>5,000 $35,000 As you can see, your take-home pay is significantly lower than your gross income due to taxes and other deductions.

In summary, a New York paycheck calculator can help you estimate your take-home pay and understand the factors that affect it. By taking advantage of tax-advantaged retirement accounts, claiming all eligible deductions and credits, negotiating your salary, and considering itemizing deductions, you can minimize your tax liability and maximize your take-home pay.

What is the average tax rate in New York?

+The average tax rate in New York is around 6.09%, which includes federal, state, and local taxes.

How do I calculate my take-home pay in New York?

+You can use a New York paycheck calculator to estimate your take-home pay, or you can consult with a tax professional or financial advisor to get a more accurate calculation.

What are some common deductions and credits available in New York?

+Some common deductions and credits available in New York include the earned income tax credit (EITC), child tax credit, and deductions for mortgage interest and medical expenses.