Military

North Carolina Paycheck Calculator

Understanding the North Carolina Paycheck Calculator

The North Carolina Paycheck Calculator is a tool designed to help employees and employers calculate the net pay of an employee after deducting federal and state taxes. It takes into account various factors such as gross income, number of dependents, filing status, and other deductions to provide an accurate calculation. In this article, we will explore the features and benefits of using a North Carolina paycheck calculator.

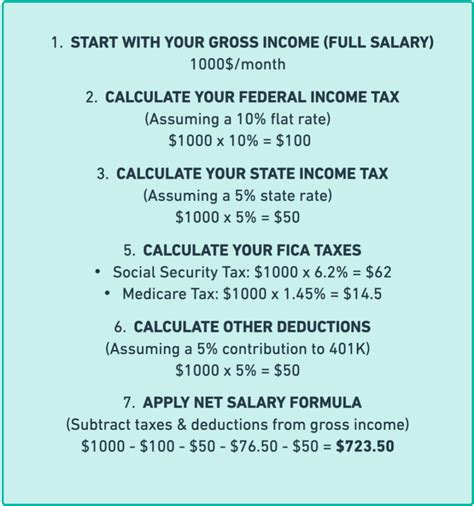

How to Use the North Carolina Paycheck Calculator

Using a North Carolina paycheck calculator is straightforward. Here are the steps to follow: * Enter the employee’s gross income, which is the total amount of money earned before any deductions. * Select the filing status, which can be single, married, head of household, or qualifying widow(er). * Enter the number of dependents, which can include children, spouses, or other relatives. * Choose the pay frequency, which can be weekly, bi-weekly, monthly, or annually. * Enter any other deductions, such as 401(k) contributions, health insurance premiums, or other benefits. * Click the calculate button to get the net pay.

Benefits of Using a North Carolina Paycheck Calculator

There are several benefits of using a North Carolina paycheck calculator, including: * Accuracy: The calculator ensures that the net pay is calculated accurately, taking into account all the relevant factors. * Time-saving: The calculator saves time and effort, as it eliminates the need for manual calculations. * Convenience: The calculator is available online, making it easily accessible from anywhere. * Flexibility: The calculator allows users to make changes to the input fields and recalculate the net pay.

Tax Rates in North Carolina

North Carolina has a progressive tax system, which means that the tax rate increases as the income level increases. The tax rates in North Carolina range from 4.99% to 5.25%. The tax rates are as follows:

| Income Level | Tax Rate |

|---|---|

| 0 - 12,750 | 4.99% |

| 12,751 - 20,000 | 5.12% |

| 20,001 - 50,000 | 5.25% |

| $50,001 and above | 5.25% |

Other Deductions and Benefits

In addition to federal and state taxes, there are other deductions and benefits that may be applicable, such as: * 401(k) contributions: Contributions to a 401(k) plan are tax-deductible and can reduce the taxable income. * Health insurance premiums: Premiums paid for health insurance may be tax-deductible. * Other benefits: Other benefits, such as life insurance, disability insurance, and flexible spending accounts, may also be applicable.

📝 Note: It's essential to consult with a tax professional or financial advisor to ensure that all applicable deductions and benefits are taken into account.

Conclusion Summary

In summary, the North Carolina paycheck calculator is a valuable tool for employees and employers to calculate the net pay of an employee. It takes into account various factors, such as gross income, filing status, and other deductions, to provide an accurate calculation. By using a paycheck calculator, users can ensure that their net pay is calculated accurately and efficiently.

What is the North Carolina paycheck calculator used for?

+The North Carolina paycheck calculator is used to calculate the net pay of an employee after deducting federal and state taxes.

How do I use the North Carolina paycheck calculator?

+To use the calculator, enter the employee’s gross income, filing status, number of dependents, and other deductions, and click the calculate button.

What are the tax rates in North Carolina?

+The tax rates in North Carolina range from 4.99% to 5.25%, depending on the income level.