Paycheck Estimator Missouri

Introduction to Paycheck Estimator in Missouri

Missouri, like other states, has its own set of tax laws and regulations that affect the take-home pay of its residents. Understanding how these laws impact your paycheck can be crucial for managing your finances effectively. A paycheck estimator is a tool designed to help individuals estimate their net pay based on their gross income, deductions, and the specific tax rules in Missouri. This guide will delve into the details of using a paycheck estimator in Missouri, including the factors that influence your take-home pay and how to use such a tool effectively.

Factors Influencing Take-Home Pay in Missouri

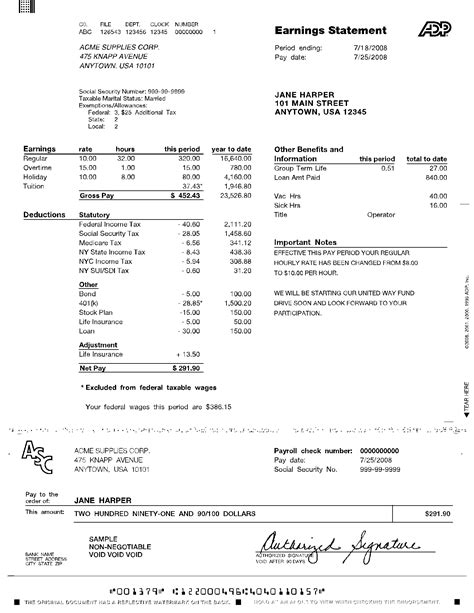

Several factors can influence the take-home pay of an individual in Missouri. These include: - Gross Income: The total amount of money earned before any deductions. - Tax Filing Status: Whether you are single, married, head of household, etc., as it affects your tax rates. - Number of Allowances: Claimed on your W-4 form, which determines the amount of taxes withheld. - Deductions: Contributions to 401(k), health insurance, and other pre-tax deductions reduce taxable income. - Missouri State Income Tax: Missouri has a progressive income tax system, with rates ranging from 1.5% to 5.2%. - Federal Income Tax: Applied based on federal tax brackets and rates.

Using a Paycheck Estimator in Missouri

To use a paycheck estimator for Missouri, follow these steps: 1. Input Your Gross Income: Start by entering how much you earn before taxes and deductions. 2. Choose Your Tax Filing Status: Select your status as it pertains to your tax return. 3. Enter Number of Allowances: Based on your W-4 form, this will affect how much tax is withheld. 4. List Deductions: Include any pre-tax deductions you have, such as retirement contributions or health insurance premiums. 5. Select Missouri as Your State: Ensure the estimator accounts for Missouri state taxes. 6. Calculate: The estimator will then provide an estimate of your net pay, considering federal and state taxes, as well as any deductions you’ve listed.

Benefits of Using a Paycheck Estimator

Using a paycheck estimator can offer several benefits, including: - Financial Planning: Knowing your take-home pay helps in creating a more accurate budget. - Tax Planning: Understanding how much you’re paying in taxes can help in planning tax savings strategies. - Decision Making: For decisions like whether to opt for additional deductions or how to manage income between spouses.

Important Considerations

When using a paycheck estimator, keep the following in mind: - Accuracy: The estimator’s accuracy depends on the data entered. Ensure all information is correct and up-to-date. - Changes in Tax Law: Tax laws and rates can change, affecting the estimator’s calculations. - Individual Circumstances: Unique situations, such as freelance income or investments, may not be fully accounted for by all estimators.

📝 Note: It's always a good idea to consult with a financial advisor or tax professional for personalized advice, especially if you have complex financial situations.

Conclusion and Next Steps

In summary, a paycheck estimator is a valuable tool for anyone looking to understand their financial situation better, especially in relation to taxes and take-home pay in Missouri. By considering the various factors that influence your net pay and using a paycheck estimator effectively, you can make more informed decisions about your finances. Remember, financial planning is an ongoing process, and staying informed about tax laws and utilizing tools like paycheck estimators can help you navigate the complexities of personal finance with more ease.

What is the purpose of a paycheck estimator in Missouri?

+

A paycheck estimator helps individuals estimate their net pay based on gross income, deductions, and Missouri’s tax laws, aiding in financial planning and decision-making.

How do I use a paycheck estimator for Missouri?

+

To use a paycheck estimator, input your gross income, select your tax filing status, enter the number of allowances, list any deductions, select Missouri as your state, and then calculate to get an estimate of your net pay.

What factors can influence the accuracy of a paycheck estimator in Missouri?

+

The accuracy of a paycheck estimator can be influenced by the correctness of the input data, changes in tax laws, and individual circumstances that may not be fully accounted for by the estimator.