Pro Tips: Design Delaware Paycheck Calculator Now

Introduction

Welcome to our comprehensive guide on the Delaware Paycheck Calculator! As a resident of Delaware, understanding your paycheck and its calculations is crucial for managing your finances effectively. In this blog post, we will explore the ins and outs of the Delaware Paycheck Calculator, providing you with valuable insights and practical tips to navigate your earnings and deductions with ease. Whether you’re an employee or an employer, this guide will equip you with the knowledge to make informed decisions about your payroll.

Understanding the Delaware Paycheck Calculator

The Delaware Paycheck Calculator is a powerful tool designed to simplify the process of calculating your earnings and deductions. It takes into account various factors, such as your gross income, tax rates, and any applicable deductions, to provide an accurate estimate of your net pay. By utilizing this calculator, you can gain a clear understanding of your financial situation and plan your budget accordingly.

Key Components of the Calculator

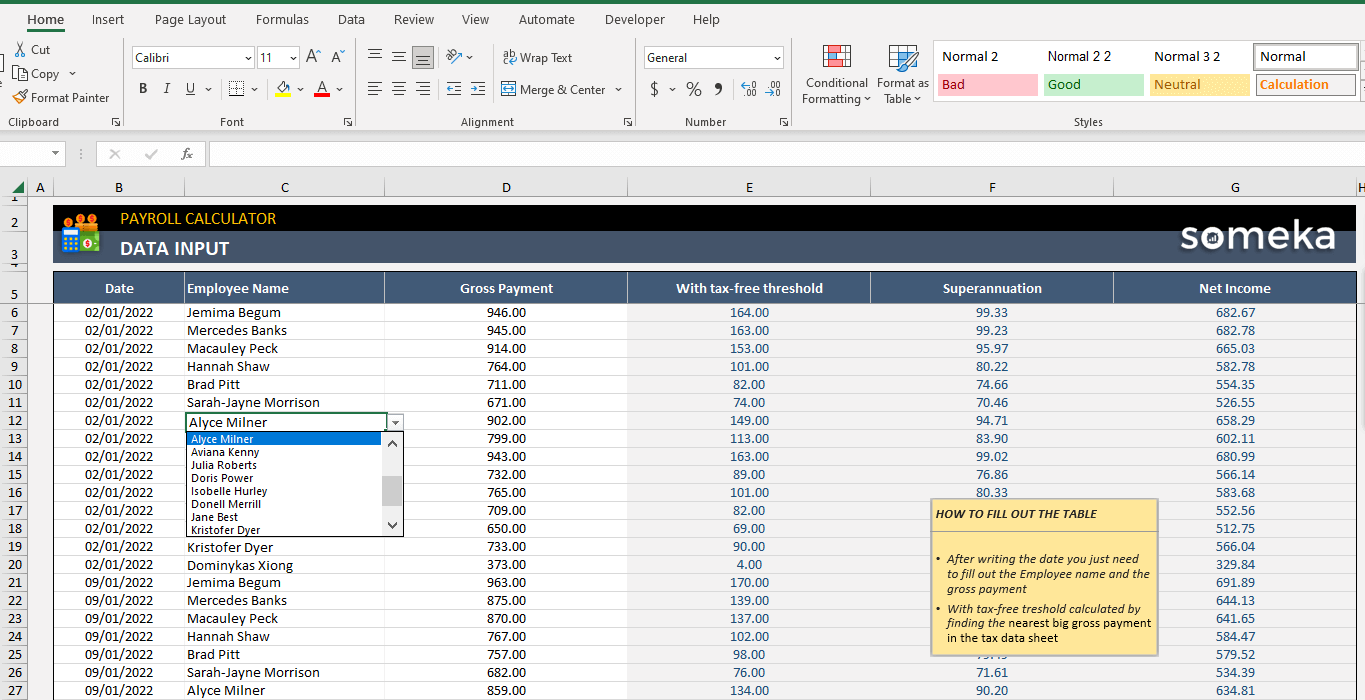

Gross Income

Your gross income is the starting point for any paycheck calculation. It represents the total amount of money you earn before any deductions are applied. This includes your base salary, overtime pay, bonuses, and any other additional earnings. When using the Delaware Paycheck Calculator, ensure that you input your gross income accurately to obtain precise results.

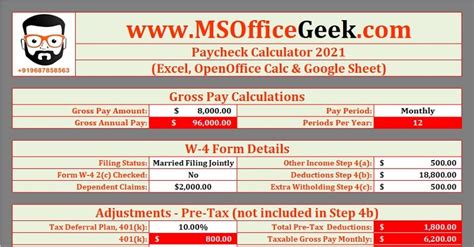

Tax Withholdings

Tax withholdings play a significant role in determining your net pay. Delaware has its own tax rates and regulations, which are factored into the calculator. The calculator considers factors such as your filing status (single, married, or head of household), the number of allowances claimed on your W-4 form, and any additional state-specific deductions. By inputting your tax information accurately, you can estimate your tax liability and plan for any potential tax payments or refunds.

Deductions and Contributions

In addition to tax withholdings, there are various other deductions and contributions that can impact your paycheck. These may include health insurance premiums, retirement plan contributions (such as 401(k) or pension plans), and any voluntary deductions for benefits like flexible spending accounts or transit passes. The Delaware Paycheck Calculator allows you to input these deductions to provide a comprehensive view of your net pay.

Using the Delaware Paycheck Calculator

Step-by-Step Guide

- Access the Calculator: Begin by visiting the official Delaware Division of Revenue website or utilizing a reputable online paycheck calculator specifically designed for Delaware residents.

- Enter Your Information: Start by inputting your gross income, including any additional earnings. Ensure that you provide accurate details to obtain precise calculations.

- Select Your Filing Status: Choose your filing status (single, married filing jointly, married filing separately, or head of household) to determine the applicable tax rates and deductions.

- Claim Allowances: Input the number of allowances you claim on your W-4 form. This information is crucial for calculating your tax withholdings accurately.

- Add Deductions and Contributions: Enter any additional deductions or contributions, such as health insurance premiums or retirement plan contributions. Be sure to include all relevant information to ensure an accurate estimate.

- Calculate Your Net Pay: Once you have provided all the necessary details, the calculator will process your information and generate an estimate of your net pay. This includes your take-home pay after all deductions and contributions have been applied.

Tips for Accurate Calculations

- Stay Informed: Keep yourself updated on any changes in Delaware’s tax laws and regulations. The calculator’s accuracy relies on up-to-date information, so be sure to refer to the latest guidelines provided by the Delaware Division of Revenue.

- Review Your Pay Stubs: Compare the calculations from the Delaware Paycheck Calculator with your actual pay stubs to ensure consistency. This will help you identify any discrepancies and make necessary adjustments.

- Consult a Professional: If you have complex financial situations or specific questions, consider seeking advice from a certified public accountant (CPA) or a tax professional. They can provide personalized guidance based on your unique circumstances.

Benefits of Using the Calculator

Financial Planning

The Delaware Paycheck Calculator empowers you to take control of your financial planning. By understanding your net pay and the various deductions, you can create a realistic budget, set financial goals, and make informed decisions about your spending and savings. It allows you to anticipate your take-home pay and plan for any significant expenses or investments.

Tax Preparation

Accurate paycheck calculations are essential for tax preparation. The Delaware Paycheck Calculator provides you with an estimate of your tax liability, helping you plan for any potential tax payments or refunds. By staying on top of your tax obligations, you can avoid surprises during tax season and ensure compliance with Delaware’s tax regulations.

Employee Benefits Awareness

Using the calculator allows you to gain a comprehensive understanding of your employee benefits. You can see the impact of deductions for benefits such as health insurance, retirement plans, and flexible spending accounts on your net pay. This awareness empowers you to make informed decisions about your benefits and maximize their value.

Conclusion

The Delaware Paycheck Calculator is a valuable tool for both employees and employers to navigate the complexities of payroll calculations. By following the step-by-step guide and implementing the provided tips, you can ensure accurate and reliable paycheck estimates. Understanding your earnings, deductions, and net pay is crucial for effective financial management. Remember to stay informed about Delaware’s tax laws, review your pay stubs, and seek professional advice when needed. With the Delaware Paycheck Calculator, you can take control of your finances and make informed decisions about your financial future.

FAQ

How often should I use the Delaware Paycheck Calculator?

+It is recommended to use the calculator whenever there are significant changes in your income, deductions, or tax laws. This ensures that your calculations remain accurate and up-to-date.

Can I trust online paycheck calculators for Delaware residents?

+Yes, reputable online paycheck calculators, such as those provided by trusted financial institutions or government websites, are generally reliable. However, it is essential to verify the accuracy of the calculator by comparing its results with your actual pay stubs.

What should I do if I notice discrepancies between the calculator’s estimate and my pay stubs?

+If you notice any discrepancies, it is advisable to review your pay stubs carefully and identify any differences in income, deductions, or tax withholdings. You can then adjust your calculator inputs accordingly to ensure accuracy.

Are there any limitations to the Delaware Paycheck Calculator?

+While the calculator provides a valuable estimate, it may not account for all unique circumstances or complex financial situations. In such cases, consulting a tax professional or a certified public accountant is recommended for personalized advice.