Sc Pay Calculator

Introduction to SC Pay Calculator

The SC Pay Calculator is a tool designed to help individuals calculate their salary or paycheck amounts based on various factors such as gross income, tax deductions, and benefits. This calculator is particularly useful for employees in South Carolina, as it takes into account the state’s specific tax laws and regulations. In this article, we will explore the features and benefits of the SC Pay Calculator, as well as provide a step-by-step guide on how to use it.

Features of the SC Pay Calculator

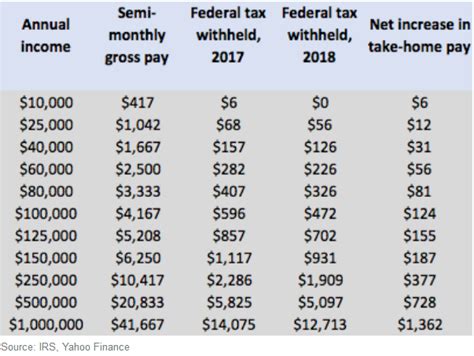

The SC Pay Calculator offers a range of features that make it an essential tool for employees in South Carolina. Some of the key features include: * Gross income calculation: The calculator allows users to input their gross income, which is then used to calculate their net pay. * Tax deductions: The calculator takes into account various tax deductions, including federal income tax, state income tax, and local taxes. * Benefits calculation: The calculator also allows users to input their benefits, such as health insurance, retirement plans, and other deductions. * Paycheck calculation: The calculator provides a detailed breakdown of the user’s paycheck, including their net pay, gross pay, and deductions.

How to Use the SC Pay Calculator

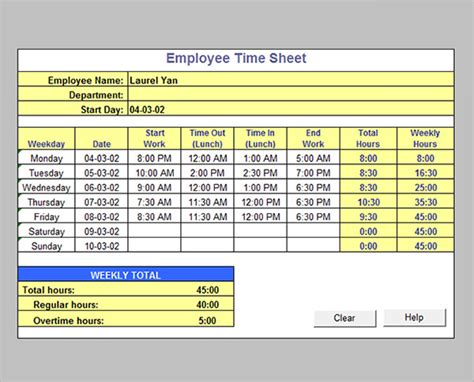

Using the SC Pay Calculator is a straightforward process that requires minimal input from the user. Here’s a step-by-step guide: * Step 1: Input gross income: Enter your gross income, which is your total income before taxes and deductions. * Step 2: Select tax filing status: Choose your tax filing status, which can be single, married, head of household, or qualifying widow(er). * Step 3: Input number of dependents: Enter the number of dependents you claim on your tax return. * Step 4: Input benefits and deductions: Enter your benefits and deductions, such as health insurance, retirement plans, and other deductions. * Step 5: Calculate paycheck: Click the “Calculate” button to generate a detailed breakdown of your paycheck.

Benefits of Using the SC Pay Calculator

The SC Pay Calculator offers several benefits to employees in South Carolina. Some of the key benefits include: * Accurate calculations: The calculator provides accurate calculations of net pay, gross pay, and deductions. * Easy to use: The calculator is easy to use and requires minimal input from the user. * Customizable: The calculator allows users to input their specific benefits and deductions, making it a customizable tool. * Free to use: The calculator is free to use and does not require any registration or subscription.

💡 Note: The SC Pay Calculator is for estimation purposes only and should not be used as a substitute for professional tax advice.

Common Uses of the SC Pay Calculator

The SC Pay Calculator has several common uses, including: * Salary negotiations: The calculator can be used to negotiate salary with employers, taking into account taxes and deductions. * Tax planning: The calculator can be used to plan taxes and estimate tax liability. * Benefits planning: The calculator can be used to plan benefits and estimate the impact of benefits on take-home pay. * Financial planning: The calculator can be used to plan finances and estimate net pay.

| Gross Income | Net Pay | Tax Deductions |

|---|---|---|

| $50,000 | $35,000 | $15,000 |

| $60,000 | $40,000 | $20,000 |

| $70,000 | $45,000 | $25,000 |

In summary, the SC Pay Calculator is a useful tool for employees in South Carolina, providing accurate calculations of net pay, gross pay, and deductions. By following the steps outlined in this article, users can easily use the calculator to estimate their paycheck and plan their finances.

To wrap things up, the SC Pay Calculator is an essential tool for anyone looking to estimate their paycheck and plan their finances. With its easy-to-use interface and customizable features, it’s a must-have for employees in South Carolina.

What is the SC Pay Calculator?

+The SC Pay Calculator is a tool designed to help individuals calculate their salary or paycheck amounts based on various factors such as gross income, tax deductions, and benefits.

How do I use the SC Pay Calculator?

+To use the SC Pay Calculator, simply input your gross income, select your tax filing status, input your number of dependents, and input your benefits and deductions. Then, click the “Calculate” button to generate a detailed breakdown of your paycheck.

Is the SC Pay Calculator free to use?

+Yes, the SC Pay Calculator is free to use and does not require any registration or subscription.