Shelter Insurance Quote

Understanding Shelter Insurance Quotes

When it comes to protecting your home and belongings, having the right insurance coverage is essential. Shelter Insurance is one of the reputable insurance companies that offer a range of policies to suit different needs and budgets. In this article, we will delve into the world of Shelter Insurance quotes, exploring what they entail, how to get them, and what factors affect their costs.

What is a Shelter Insurance Quote?

A Shelter Insurance quote is an estimate of the cost of insurance coverage provided by Shelter Insurance. It outlines the premium you need to pay to secure protection for your home, condominium, townhouse, or rental property. The quote typically includes details such as the coverage limits, deductibles, and any additional features or endorsements you may have selected.

How to Get a Shelter Insurance Quote

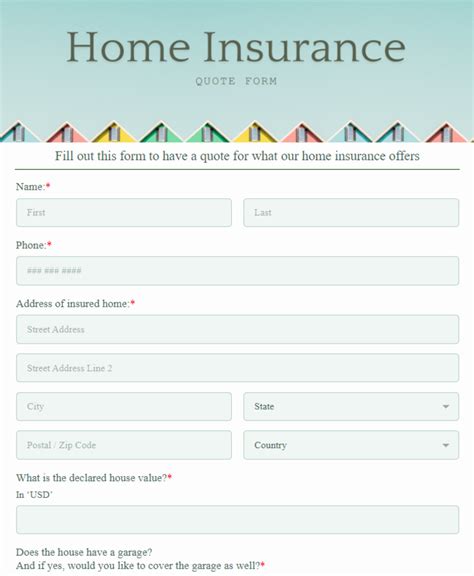

Getting a Shelter Insurance quote is relatively straightforward. You can:

- Visit the Shelter Insurance website and use their online quote tool

- Call their customer service number to speak with a licensed agent

- Meet with a local Shelter Insurance agent in person

- Location and value of the property

- Type of property (single-family home, condo, townhouse, etc.)

- Number of bedrooms and bathrooms

- Year the property was built

- Any notable features or upgrades (e.g., swimming pool, security system)

Factors Affecting Shelter Insurance Quote Costs

The cost of a Shelter Insurance quote is influenced by several factors, including:

- Location: Properties in areas prone to natural disasters or with high crime rates may be more expensive to insure

- Property value: The higher the value of your property, the more it will cost to insure

- Deductible: Choosing a higher deductible can lower your premium, but you will need to pay more out-of-pocket in the event of a claim

- Coverage limits: The more coverage you select, the higher your premium will be

- Claims history: If you have a history of filing claims, your premium may be higher

- Credit score: In some states, insurance companies can use credit scores to determine premiums

Understanding Shelter Insurance Policy Options

Shelter Insurance offers a range of policy options to suit different needs and budgets. Some of the available options include:

- Homeowners insurance: Provides coverage for your primary residence

- Condo insurance: Designed for condominium owners, this policy covers the interior of your unit and personal belongings

- Renters insurance: Protects your personal belongings and provides liability coverage as a renter

- Flood insurance: Provides coverage for flood-related damage, which is not typically included in standard homeowners policies

Additional Features and Endorsements

Shelter Insurance also offers additional features and endorsements to enhance your policy, such as:

- Personal umbrella insurance: Provides extra liability coverage to protect your assets

- Earthquake insurance: Covers damage caused by earthquakes, which is not typically included in standard homeowners policies

- Identity theft protection: Helps you recover from identity theft and provides reimbursement for related expenses

💡 Note: It is essential to review and understand the terms and conditions of your policy, including any exclusions or limitations, before purchasing.

Conclusion and Final Thoughts

In conclusion, Shelter Insurance quotes provide a clear estimate of the cost of insurance coverage for your home and belongings. By understanding the factors that affect quote costs and exploring the various policy options and additional features available, you can make an informed decision about your insurance needs. Remember to review and compare quotes from multiple insurance companies to ensure you find the best coverage for your budget.

What is the average cost of a Shelter Insurance quote?

+

The average cost of a Shelter Insurance quote varies depending on several factors, including location, property value, and coverage limits. It is best to get a personalized quote from a licensed agent to determine the exact cost.

Do I need to purchase flood insurance if I live in a low-risk area?

+

While flood insurance is not typically required in low-risk areas, it is still recommended to consider purchasing a policy. Floods can occur anywhere, and the damage can be devastating. Consult with a licensed agent to determine the best course of action for your specific situation.

Can I customize my Shelter Insurance policy to fit my specific needs?

+

Yes, Shelter Insurance policies can be customized to fit your specific needs. You can work with a licensed agent to select the coverage options and endorsements that best suit your situation. This may include adding additional features, such as personal umbrella insurance or identity theft protection.