South Carolina Insurance Commissioner

Overview of the South Carolina Insurance Commissioner

The South Carolina Insurance Commissioner is a vital part of the state’s government, responsible for regulating and overseeing the insurance industry within the state. This includes ensuring that insurance companies operate fairly and in compliance with state laws, as well as protecting consumers from unfair practices. The commissioner’s office is also involved in educating the public about insurance options and rights, helping to resolve disputes between insurers and policyholders, and fostering a competitive insurance market that benefits all parties.

Responsibilities of the South Carolina Insurance Commissioner

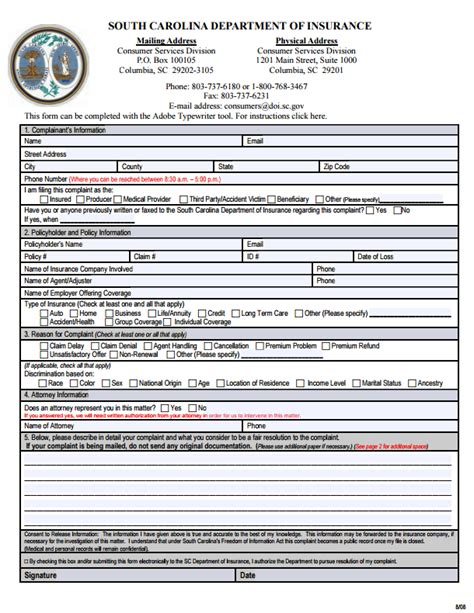

The responsibilities of the South Carolina Insurance Commissioner are diverse and critical to the state’s insurance landscape. Key duties include: - Licensing Insurance Companies: The commissioner is responsible for licensing insurance companies to operate in South Carolina. This involves ensuring that these companies have the financial capability and meet the legal requirements to provide insurance services within the state. - Regulating Insurance Rates: The commissioner’s office reviews and approves insurance rates to ensure they are not excessive or unfairly discriminatory. This helps maintain a competitive market while protecting consumers from price gouging. - Investigating Consumer Complaints: When policyholders have complaints against insurance companies, the commissioner’s office investigates these claims. They work to resolve disputes and ensure that insurance companies are treating their customers fairly. - Educating the Public: Part of the commissioner’s role is to educate the public about insurance matters. This can include providing information on types of insurance, how to file claims, and understanding insurance policies. - Enforcing Insurance Laws: The commissioner is tasked with enforcing state insurance laws and regulations. This includes conducting audits and examinations of insurance companies to ensure compliance.

Importance of the South Carolina Insurance Commissioner

The role of the South Carolina Insurance Commissioner is pivotal for several reasons: - Consumer Protection: Perhaps most importantly, the commissioner acts as a consumer advocate, protecting policyholders from unfair practices and ensuring they receive the benefits they are entitled to under their insurance policies. - Market Stability: By regulating insurance companies and ensuring they operate on a sound financial basis, the commissioner helps maintain stability in the insurance market. This stability is crucial for attracting and retaining insurance companies in the state, which in turn benefits consumers through more competitive pricing and better services. - Economic Impact: The insurance industry has a significant economic impact on South Carolina, providing employment and contributing to the state’s revenue. The commissioner’s efforts to foster a healthy insurance market can have broader economic benefits.

Challenges Facing the South Carolina Insurance Commissioner

Like many regulatory bodies, the South Carolina Insurance Commissioner faces several challenges, including: - Balancing Regulation and Competition: There is a delicate balance between regulating insurance companies to protect consumers and allowing enough freedom for competition to flourish. Too much regulation can stifle innovation and competition, while too little can expose consumers to risk. - Keeping Pace with Industry Changes: The insurance industry is evolving rapidly, with changes in technology, consumer behavior, and risk profiles. The commissioner’s office must stay abreast of these changes to effectively regulate the industry and protect consumers. - Natural Disasters and Insurance Claims: South Carolina is prone to natural disasters like hurricanes, which can lead to a surge in insurance claims. The commissioner’s office plays a crucial role in ensuring that insurance companies handle these claims efficiently and fairly.

📝 Note: The commissioner's office often works closely with other state agencies and federal bodies to address these challenges and ensure a coordinated response to major events like natural disasters.

Future of the South Carolina Insurance Commissioner

Looking ahead, the South Carolina Insurance Commissioner will likely face new challenges and opportunities, particularly in areas like: - Technological Innovation: As insurance technology (insurtech) continues to evolve, the commissioner’s office will need to navigate how to regulate new products and services while encouraging innovation. - Climate Change: With the increasing impact of climate change, the commissioner will play a vital role in ensuring that the insurance industry is prepared to handle related risks and claims. - Consumer Education: There will be a continued emphasis on educating consumers about their insurance options, especially as the insurance landscape becomes more complex.

In summary, the South Carolina Insurance Commissioner plays a critical role in regulating the insurance industry, protecting consumers, and fostering a competitive market. As the insurance landscape continues to evolve, the commissioner’s office will need to adapt to new challenges and opportunities to ensure the stability and fairness of the insurance market in South Carolina.

What is the primary role of the South Carolina Insurance Commissioner?

+

The primary role of the South Carolina Insurance Commissioner is to regulate and oversee the insurance industry within the state, ensuring that insurance companies operate fairly and in compliance with state laws, and protecting consumers from unfair practices.

How does the South Carolina Insurance Commissioner protect consumers?

+

The commissioner protects consumers by investigating complaints, ensuring insurance companies comply with state laws, regulating insurance rates, and educating the public about their insurance rights and options.

What challenges does the South Carolina Insurance Commissioner face?

+

The commissioner faces challenges such as balancing regulation with competition, keeping pace with industry changes, and handling the impact of natural disasters on insurance claims.