Military

Tax Estimator Maryland

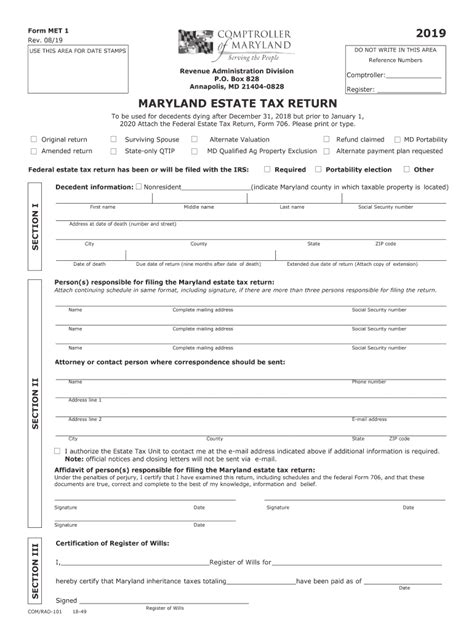

Introduction to Maryland Tax Estimator

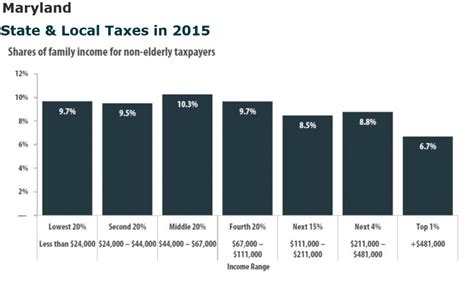

Maryland taxpayers can breathe a sigh of relief with the advent of tax estimators, which help them calculate their tax liabilities accurately. A tax estimator is a tool that uses the taxpayer’s income, deductions, and credits to estimate the amount of taxes they owe. In this blog post, we will delve into the world of Maryland tax estimators, exploring their benefits, how they work, and what taxpayers need to know to use them effectively.

Benefits of Using a Maryland Tax Estimator

Using a Maryland tax estimator offers several benefits to taxpayers. Some of the most significant advantages include: * Accuracy: Tax estimators help taxpayers calculate their tax liabilities accurately, reducing the risk of errors and penalties. * Convenience: Tax estimators are often available online, making it easy for taxpayers to access them from anywhere and at any time. * Time-saving: Tax estimators can save taxpayers a significant amount of time, as they automate the calculation process and provide instant results. * Peace of mind: By using a tax estimator, taxpayers can get an idea of their tax liabilities and plan accordingly, reducing stress and anxiety.

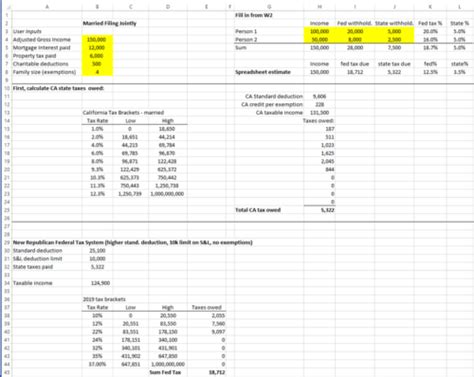

How Maryland Tax Estimators Work

Maryland tax estimators work by using a taxpayer’s income, deductions, and credits to estimate their tax liabilities. The process typically involves the following steps: * Gathering information: Taxpayers need to gather their financial information, including income, deductions, and credits. * Entering data: Taxpayers enter their financial information into the tax estimator tool. * Calculation: The tax estimator tool calculates the taxpayer’s tax liabilities based on the entered data. * Results: The tax estimator tool provides the taxpayer with an estimate of their tax liabilities.

Types of Maryland Tax Estimators

There are several types of Maryland tax estimators available, including: * Online tax estimators: These are web-based tools that can be accessed from anywhere and at any time. * Software-based tax estimators: These are software programs that need to be installed on a computer or mobile device. * Consultant-based tax estimators: These involve working with a tax consultant who uses their expertise to estimate tax liabilities.

What to Consider When Using a Maryland Tax Estimator

When using a Maryland tax estimator, taxpayers need to consider the following factors: * Accuracy of data: Taxpayers need to ensure that the data they enter is accurate and up-to-date. * Complexity of tax situation: Taxpayers with complex tax situations may need to use a more advanced tax estimator or consult with a tax professional. * Security of data: Taxpayers need to ensure that their financial information is secure and protected from unauthorized access.

📝 Note: Taxpayers should always review their tax estimates carefully and seek professional help if they are unsure about any aspect of their tax situation.

Common Mistakes to Avoid When Using a Maryland Tax Estimator

When using a Maryland tax estimator, taxpayers need to avoid the following common mistakes: * Incorrect data entry: Taxpayers need to ensure that they enter their financial information accurately and correctly. * Failure to account for deductions and credits: Taxpayers need to ensure that they account for all eligible deductions and credits. * Failure to update tax information: Taxpayers need to ensure that they update their tax information regularly to reflect changes in their financial situation.

Conclusion

In conclusion, Maryland tax estimators are powerful tools that can help taxpayers calculate their tax liabilities accurately and efficiently. By understanding how tax estimators work, what types are available, and what to consider when using them, taxpayers can make informed decisions about their tax situation. Whether you are a seasoned taxpayer or just starting out, a Maryland tax estimator can be a valuable resource in navigating the complex world of taxation.

What is a Maryland tax estimator?

+A Maryland tax estimator is a tool that helps taxpayers calculate their tax liabilities based on their income, deductions, and credits.

How do I use a Maryland tax estimator?

+To use a Maryland tax estimator, simply gather your financial information, enter it into the tool, and review the estimated tax liabilities.

What are the benefits of using a Maryland tax estimator?

+The benefits of using a Maryland tax estimator include accuracy, convenience, time-saving, and peace of mind.