Texas Payroll Calculator

Introduction to Texas Payroll Calculator

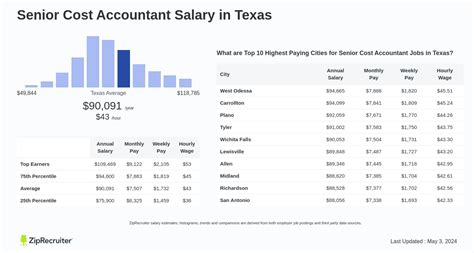

The Texas Payroll Calculator is a tool designed to help employers and employees calculate the amount of payroll taxes owed to the state of Texas. Payroll taxes are an essential part of the employment process, and understanding how to calculate them is crucial for compliance with state and federal regulations. In this article, we will delve into the world of Texas payroll taxes, exploring the different types of taxes, how to calculate them, and the importance of using a payroll calculator.

Types of Payroll Taxes in Texas

There are several types of payroll taxes in Texas, including: * Federal Income Tax: This is a tax on the income earned by employees, which is withheld by the employer and paid to the federal government. * State Income Tax: Texas does not have a state income tax, which means that employees do not have to pay state income tax on their earnings. * Social Security Tax: This is a tax on the income earned by employees, which is used to fund social security benefits. * Medicare Tax: This is a tax on the income earned by employees, which is used to fund Medicare benefits. * Unemployment Tax: This is a tax on the income earned by employees, which is used to fund unemployment benefits.

How to Calculate Payroll Taxes in Texas

Calculating payroll taxes in Texas can be a complex process, involving several steps and formulas. Here are the general steps to follow: * Determine the employee’s gross income for the pay period. * Calculate the federal income tax withholding using the federal income tax tables. * Calculate the social security tax withholding using the social security tax rate. * Calculate the Medicare tax withholding using the Medicare tax rate. * Calculate the unemployment tax withholding using the unemployment tax rate.

📝 Note: It is essential to use the correct tax rates and tables to ensure accurate calculations.

Importance of Using a Payroll Calculator

Using a payroll calculator can help simplify the process of calculating payroll taxes in Texas. A payroll calculator can: * Reduce errors: By automating the calculation process, a payroll calculator can reduce the risk of errors and ensure accuracy. * Save time: A payroll calculator can save time and effort, allowing employers to focus on other aspects of their business. * Ensure compliance: A payroll calculator can help ensure compliance with state and federal regulations, reducing the risk of penalties and fines.

Features of a Texas Payroll Calculator

A good Texas payroll calculator should have the following features: * Accurate calculations: The calculator should use the correct tax rates and tables to ensure accurate calculations. * Easy to use: The calculator should be easy to use, with a simple and intuitive interface. * Customizable: The calculator should allow users to customize the calculations based on their specific needs. * Up-to-date: The calculator should be updated regularly to reflect changes in tax rates and regulations.

| Feature | Description |

|---|---|

| Accurate calculations | The calculator uses the correct tax rates and tables to ensure accurate calculations. |

| Easy to use | The calculator has a simple and intuitive interface, making it easy to use. |

| Customizable | The calculator allows users to customize the calculations based on their specific needs. |

| Up-to-date | The calculator is updated regularly to reflect changes in tax rates and regulations. |

To summarize, calculating payroll taxes in Texas can be a complex process, but using a payroll calculator can simplify the process and ensure accuracy. By understanding the different types of payroll taxes, how to calculate them, and the importance of using a payroll calculator, employers and employees can ensure compliance with state and federal regulations.

What is the purpose of a Texas payroll calculator?

+The purpose of a Texas payroll calculator is to help employers and employees calculate the amount of payroll taxes owed to the state of Texas.

What types of payroll taxes are calculated using a Texas payroll calculator?

+A Texas payroll calculator calculates federal income tax, social security tax, Medicare tax, and unemployment tax.

Why is it essential to use a payroll calculator for Texas payroll taxes?

+Using a payroll calculator can reduce errors, save time, and ensure compliance with state and federal regulations.