The Ultimate Guide To Financial Management For Managers: Essential Strategies To Master

Introduction to Financial Management for Managers

Financial management is a critical aspect of any business, and for managers, it is an essential skill to master. Effective financial management enables businesses to make informed decisions, optimize their operations, and achieve long-term success. As a manager, understanding the fundamentals of financial management is crucial for strategic planning, resource allocation, and ensuring the financial health of your organization.

In this comprehensive guide, we will delve into the world of financial management, providing you with essential strategies and insights to navigate the financial landscape effectively. Whether you are a seasoned manager or just starting your journey, this guide will equip you with the knowledge and tools to make sound financial decisions and drive your organization toward financial prosperity.

Understanding Financial Statements

Financial statements are the cornerstone of financial management. They provide a snapshot of a company’s financial performance and position, offering valuable insights to managers and stakeholders. Here’s a breakdown of the key financial statements:

Income Statement: Also known as the profit and loss statement, it showcases a company’s revenue, expenses, and net income over a specific period. It helps managers assess the profitability and performance of their business.

Balance Sheet: This statement presents a company’s assets, liabilities, and equity at a specific point in time. It provides a clear picture of the company’s financial health and its ability to meet its obligations.

Cash Flow Statement: Focused on cash inflows and outflows, this statement highlights a company’s liquidity and its ability to generate cash. It is crucial for understanding the company’s cash management strategies.

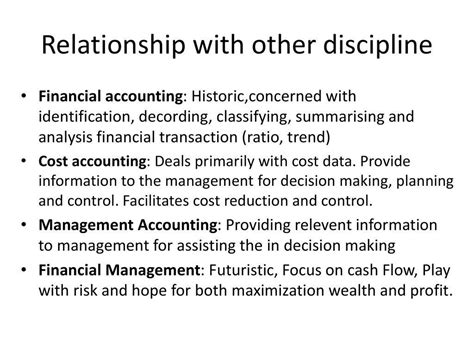

Analyzing Financial Data

Analyzing financial data is a crucial step in financial management. It involves interpreting the information presented in financial statements and identifying trends, patterns, and areas of improvement. Here are some key aspects to consider:

Ratio Analysis: Ratios such as profitability ratios (e.g., gross profit margin), liquidity ratios (e.g., current ratio), and solvency ratios (e.g., debt-to-equity ratio) provide valuable insights into a company’s financial performance and stability.

Trend Analysis: Comparing financial data over multiple periods allows managers to identify trends and make informed predictions. It helps in forecasting future financial performance and setting realistic goals.

Benchmarking: Comparing your company’s financial performance with industry averages or competitors can provide a benchmark for improvement. It highlights areas where your business excels and areas that require attention.

Budgeting and Forecasting

Budgeting and forecasting are essential tools for financial planning and control. They involve creating financial plans, setting targets, and predicting future financial outcomes. Here’s a closer look:

Budgeting: Creating a budget involves allocating resources, setting revenue and expense targets, and aligning financial goals with the company’s strategic objectives. It provides a roadmap for financial management.

Forecasting: Forecasting involves predicting future financial performance based on historical data, market trends, and external factors. It helps managers anticipate challenges and opportunities, allowing for proactive decision-making.

Variance Analysis: Comparing actual financial results with budgeted figures is known as variance analysis. It identifies deviations and helps managers understand the reasons behind them, enabling course corrections.

Cost Management and Control

Cost management is a critical aspect of financial management, as it directly impacts a company’s profitability. Managers must implement strategies to control and optimize costs effectively. Here are some key strategies:

Cost Analysis: Analyzing costs, both fixed and variable, helps managers identify areas where cost-cutting measures can be implemented without compromising quality or efficiency.

Cost-Benefit Analysis: This analysis involves evaluating the potential benefits of a decision or investment against its costs. It assists managers in making informed choices and prioritizing initiatives.

Cost Control Techniques: Techniques such as activity-based costing, value engineering, and cost-plus pricing help managers allocate resources efficiently and ensure cost-effective operations.

Financial Planning and Decision Making

Financial planning is a crucial process that guides managers in making strategic decisions. It involves evaluating various financial options, assessing risks, and choosing the most suitable course of action. Here’s an overview:

Financial Planning Process: The financial planning process typically involves defining goals, gathering relevant data, analyzing options, and implementing and monitoring the chosen strategy.

Capital Budgeting: Capital budgeting decisions involve evaluating large-scale investments, such as purchasing new equipment or expanding operations. Managers must assess the potential returns and risks associated with these investments.

Working Capital Management: Effective management of working capital, including inventory, accounts receivable, and accounts payable, is essential for maintaining liquidity and optimizing cash flow.

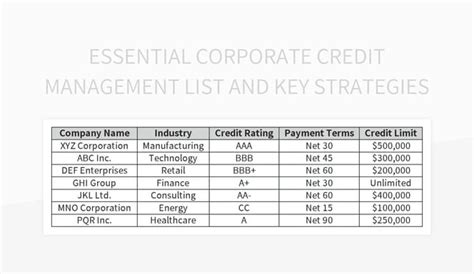

Risk Management and Financial Strategies

Risk management is an integral part of financial management, as it helps businesses navigate uncertainties and potential threats. Managers must develop strategies to mitigate financial risks effectively. Here are some key considerations:

Risk Identification: Identifying potential risks, such as market fluctuations, economic downturns, or changes in regulations, is the first step in risk management.

Risk Assessment: Once risks are identified, managers must assess their potential impact on the business. This involves evaluating the likelihood and severity of each risk.

Risk Mitigation Strategies: Strategies such as diversification, hedging, insurance, and contingency planning help businesses reduce the impact of risks and protect their financial well-being.

Implementing Financial Management Systems

To streamline financial management processes, managers can leverage specialized financial management systems. These systems offer automated tools and functionalities to enhance efficiency and accuracy. Here’s an overview:

Accounting Software: Accounting software, such as QuickBooks or Xero, provides features for managing accounts payable, accounts receivable, payroll, and generating financial reports.

Enterprise Resource Planning (ERP) Systems: ERP systems integrate various business functions, including financial management, inventory management, and customer relationship management. They offer a comprehensive view of the business’s financial operations.

Performance Management Tools: These tools help managers track key performance indicators (KPIs) and monitor financial goals. They provide real-time data and insights to support decision-making.

Notes:

📝 Note: Financial management is an ongoing process that requires continuous monitoring and adaptation. Regularly review and update your financial strategies to stay aligned with your business goals and market dynamics.

Conclusion

Financial management is a complex yet crucial aspect of business management. By understanding financial statements, analyzing data, and implementing effective strategies, managers can drive their organizations toward financial success. Remember, financial management is not just about numbers; it is about making informed decisions that shape the future of your business. With the right tools and knowledge, you can navigate the financial landscape with confidence and lead your team toward prosperity.

FAQ

What are the key financial statements that managers should focus on?

+Managers should pay close attention to the income statement, balance sheet, and cash flow statement. These statements provide insights into profitability, financial health, and liquidity, respectively.

How often should financial data be analyzed and reviewed?

+Financial data analysis should be conducted regularly, ideally on a monthly basis. However, depending on the nature of the business and its financial complexity, quarterly or annual reviews may also be necessary.

What are some common challenges in financial management, and how can managers overcome them?

+Common challenges include inaccurate data, lack of financial expertise, and limited resources. Managers can overcome these challenges by investing in financial training, implementing robust financial systems, and seeking external advice when needed.

How can managers ensure effective communication of financial information to stakeholders?

+Effective communication involves presenting financial information clearly and concisely. Managers should use visual aids, such as charts and graphs, to make complex data more accessible. Additionally, providing context and explaining key financial metrics can enhance understanding.

What are some best practices for budgeting and forecasting in financial management?

+Best practices include setting realistic targets, regularly reviewing and updating budgets, and incorporating historical data and market trends into forecasts. Collaboration between finance and operational teams is also crucial for accurate budgeting and forecasting.