The Ultimate Guide To Understanding Your 1095C Form Now

Understanding Your 1095-C Form: A Comprehensive Guide

The 1095-C form is an essential document for employers and employees alike, providing crucial information about health insurance coverage. This guide will walk you through the 1095-C form, its purpose, and how to navigate its contents effectively. Whether you’re an employer or an employee, understanding this form is key to ensuring compliance with healthcare regulations.

What is the 1095-C Form?

The 1095-C form, officially known as the “Employer-Provided Health Insurance Offer and Coverage Information Return,” is a tax form issued by employers to their employees. It reports on the health insurance coverage offered and provided by the employer during the previous tax year. This form is part of the Affordable Care Act (ACA) reporting requirements and plays a vital role in verifying compliance with the ACA’s employer mandate.

Who Receives the 1095-C Form?

Employers with 50 or more full-time employees, or full-time equivalent employees, are required to provide the 1095-C form to their employees. However, even if an employer has fewer than 50 full-time employees, they may still choose to offer the form to their workforce. The form is typically sent to employees by mail or electronically, and it is essential that employees retain this document for their tax records.

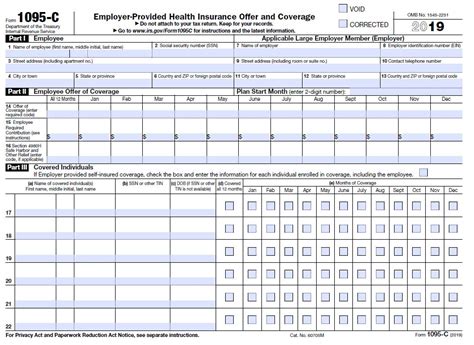

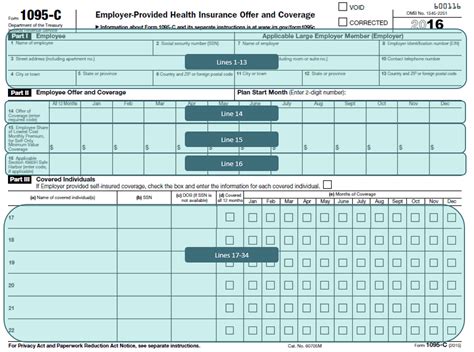

The Structure of the 1095-C Form

The 1095-C form consists of three parts:

- Part A: Contains employer and employee information, including the employer’s name, address, and Employer Identification Number (EIN). It also includes the employee’s name, address, and tax identification number (usually their Social Security Number).

- Part B: Details the months of health insurance coverage offered and provided by the employer. It indicates whether the coverage was affordable and minimum essential coverage.

- Part C: Provides additional information about the employer’s offer of health insurance coverage. This section includes details on whether the employee was enrolled in coverage, the type of coverage offered, and any applicable enrollment codes.

Key Information on the 1095-C Form

- Employee Information: Part A of the form includes the employee’s personal details, ensuring accurate reporting and record-keeping.

- Coverage Period: Part B specifies the months for which the employer offered and provided health insurance coverage. This information is crucial for verifying compliance with the ACA’s employer mandate.

- Affordability and Minimum Essential Coverage: Part B also indicates whether the offered coverage was affordable and met the minimum essential coverage requirements. This helps employees understand their healthcare options and potential tax implications.

- Enrollment Status: Part C provides details on the employee’s enrollment in the employer’s health insurance plan. It specifies whether the employee enrolled in coverage, the effective date of enrollment, and any changes in coverage during the year.

How to Read and Interpret the 1095-C Form

Reading and understanding the 1095-C form is relatively straightforward. Here’s a step-by-step guide:

- Review Part A: Start by verifying your personal information, ensuring it matches your records. Check the employer’s details to confirm you have the correct form.

- Focus on Part B: Pay close attention to the coverage period indicated in Part B. Ensure that the months of coverage align with your employment and any breaks in service.

- Affordability and Minimum Essential Coverage: Part B also includes important information about the affordability and minimum essential coverage of the offered plan. If you have questions or concerns about these aspects, consult with your employer or a tax professional.

- Part C: Enrollment Details: Review Part C to understand your enrollment status and any changes to your coverage during the year. This section provides valuable insights into your healthcare benefits and potential tax implications.

Notes for Employers

- Timely Reporting: Ensure that you meet the deadlines for providing the 1095-C form to your employees. Late filings may result in penalties.

- Accuracy is Key: Double-check the information on the form to avoid errors. Inaccurate reporting can lead to compliance issues and potential penalties.

- Employee Communication: Keep your employees informed about the 1095-C form and its importance. Provide clear instructions on how to access and understand the form.

Notes for Employees

- Retain the Form: Keep your 1095-C form in a safe place with your other tax documents. It may be required when filing your taxes or for future reference.

- Review Carefully: Take the time to review the form and ensure its accuracy. If you notice any discrepancies, contact your employer promptly.

- Seek Professional Advice: If you have questions or concerns about the form or your healthcare coverage, consult with a tax professional or healthcare advisor.

Understanding Your Healthcare Coverage

The 1095-C form provides valuable insights into your healthcare coverage and helps you understand your rights and responsibilities under the ACA. By reviewing this form, you can:

- Verify Coverage: Confirm that your employer offered and provided the required health insurance coverage.

- Assess Affordability: Understand whether the offered coverage was affordable based on your income and family size.

- Plan for Taxes: Determine if you may be eligible for a premium tax credit or if you need to pay a penalty for not having minimum essential coverage.

Visualizing the 1095-C Form

To further assist you in understanding the 1095-C form, here’s a simplified visual representation:

| Part A | Part B | Part C |

|---|---|---|

| Employer and Employee Information | Coverage Period | Enrollment Status |

| Name, Address, EIN, SSN | Months of Coverage | Enrollment Details |

| Personal Details | Affordability and Minimum Essential Coverage | Plan Type and Changes |

Conclusion: Navigating Healthcare and Taxes

The 1095-C form is a crucial document that bridges the gap between healthcare coverage and tax obligations. By understanding this form, you can make informed decisions about your healthcare and navigate the tax landscape with confidence. Whether you’re an employer ensuring compliance or an employee seeking clarity, the 1095-C form is a valuable tool for managing your healthcare and financial well-being.

FAQ

What is the purpose of the 1095-C form?

+The 1095-C form is used to report on the health insurance coverage offered and provided by employers to their employees. It ensures compliance with the Affordable Care Act’s employer mandate.

Who is required to receive the 1095-C form?

+Employers with 50 or more full-time employees must provide the 1095-C form to their workforce. However, smaller employers may also choose to offer it.

What information is included in the 1095-C form?

+The form includes employer and employee information, coverage period details, affordability and minimum essential coverage indicators, and enrollment status.

How do I read and interpret the 1095-C form?

+Review Part A for personal and employer details, Part B for coverage period and affordability, and Part C for enrollment status and plan details. Ensure the information aligns with your records.

What should I do if I have questions about the 1095-C form?

+If you have questions or concerns, consult with your employer or a tax professional for guidance and clarification.