The Ultimate Washington Dc Tax Calculator: Your Comprehensive Guide

Navigating the tax landscape of Washington D.C. can be a daunting task, but with the right tools and knowledge, it becomes a manageable process. Enter the Washington D.C. Tax Calculator, your trusted companion for all your tax-related queries and calculations. This comprehensive guide will walk you through the ins and outs of this powerful tool, ensuring you have a seamless and efficient tax experience.

Understanding the Washington D.C. Tax Calculator

The Washington D.C. Tax Calculator is an innovative online platform designed to simplify the complex world of taxation. Whether you're a resident, a business owner, or simply curious about the tax system, this calculator offers a user-friendly interface and accurate results. It covers a wide range of tax-related aspects, making it an essential tool for anyone looking to stay on top of their financial obligations.

Key Features and Benefits

-

Accurate Calculations: The calculator utilizes up-to-date tax rates and regulations, ensuring precise results for your specific situation. Whether you're calculating income tax, sales tax, or property tax, you can trust the accuracy of this tool.

-

User-Friendly Interface: With a clean and intuitive design, the Washington D.C. Tax Calculator is easy to navigate. Even if you're not an expert in taxes, the straightforward layout will guide you through the process, making it a breeze to input your information and get the results you need.

-

Comprehensive Coverage: This calculator doesn't just stop at income tax. It provides calculations for various tax types, including business taxes, payroll taxes, and even special tax scenarios like estate and gift taxes. It's your one-stop shop for all your tax calculation needs.

-

Customizable Options: Understand the flexibility to tailor your calculations to your unique circumstances. Whether you're a sole proprietor, a corporation, or an individual, the calculator allows you to input specific details, ensuring the results are relevant and accurate for your situation.

Getting Started with the Calculator

Using the Washington D.C. Tax Calculator is a straightforward process. Here's a step-by-step guide to help you get started:

-

Access the Calculator: Visit the official website of the Washington D.C. Department of Revenue or use a trusted third-party platform that offers the calculator. Ensure you're using a secure and reputable source to maintain data privacy and accuracy.

-

Select Your Tax Type: The calculator will present you with various tax categories. Choose the type of tax you wish to calculate, such as income tax, sales tax, or property tax. This step ensures you're directed to the relevant calculation form.

-

Input Your Information: Fill out the required fields with your personal or business details. Be as accurate as possible to obtain precise results. Common information required includes income, deductions, property value, or sales figures.

-

Review and Submit: Double-check your inputs to ensure accuracy. Once you're satisfied, submit the form, and the calculator will process your data.

-

View Your Results: After submission, the calculator will provide you with a detailed breakdown of your tax obligations. This includes the total tax amount, any applicable deductions or credits, and a summary of your tax liability. Review the results carefully to understand your tax situation.

Tax Calculator for Businesses

The Washington D.C. Tax Calculator is particularly beneficial for businesses operating within the district. It offers specialized calculations for:

-

Business Income Tax: Calculate your business's income tax liability based on your profits and deductions. This helps you plan your financial strategy and ensure compliance with tax regulations.

-

Sales and Use Tax: Determine the sales tax you need to collect from customers and the use tax you may owe on out-of-state purchases. This feature ensures your business stays compliant with sales tax laws.

-

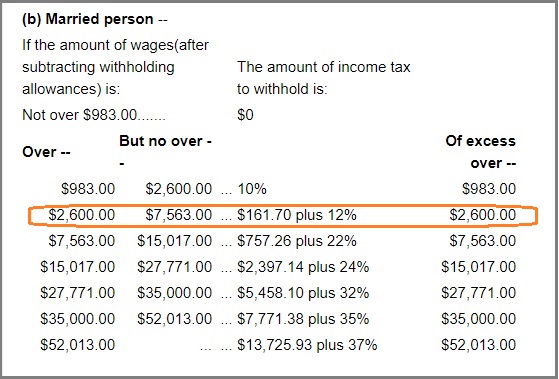

Payroll Tax: Calculate the payroll taxes you need to withhold from your employees' wages and the employer's share of payroll taxes. This simplifies the process of managing payroll and tax obligations.

Tax Calculator for Individuals

Individuals can also benefit greatly from the Washington D.C. Tax Calculator. It provides calculations for:

-

Income Tax: Calculate your personal income tax liability based on your earnings, deductions, and credits. This helps you understand your tax obligations and plan your finances accordingly.

-

Property Tax: Estimate your property tax liability based on the value of your real estate holdings. This is especially useful for homeowners or those considering property investments.

-

Estate and Gift Tax: Calculate the estate tax on the transfer of your assets upon death or the gift tax on large gifts to individuals. This ensures you're aware of any potential tax implications.

Tips and Best Practices

-

Keep Records: Maintain accurate records of your income, expenses, and deductions. This makes it easier to input correct information into the calculator and ensures you have documentation for tax purposes.

-

Stay Informed: Tax laws and regulations can change, so stay updated with the latest information. The Washington D.C. Department of Revenue provides resources and updates to keep you informed about any changes that may impact your tax calculations.

-

Seek Professional Advice: While the calculator is a valuable tool, complex tax situations may require professional guidance. Consider consulting a tax advisor or accountant for specialized advice, especially if you have unique circumstances or high-value assets.

The Bottom Line

The Washington D.C. Tax Calculator is a powerful and user-friendly tool that simplifies the complex world of taxation. Whether you're a business owner or an individual, this calculator offers accurate and reliable calculations, ensuring you stay compliant with tax regulations. By utilizing this guide and the calculator's features, you can navigate the tax landscape with confidence and ease.

Remember, while the calculator provides valuable insights, it's always a good idea to consult official sources and tax professionals for specific advice. Stay informed, keep accurate records, and use the Washington D.C. Tax Calculator as your trusted companion on your tax journey.

How often are the tax rates and regulations updated in the calculator?

+The calculator is regularly updated to reflect the latest tax rates and regulations. However, it’s always a good practice to double-check with official sources or tax professionals for the most current information, especially during tax season or when significant changes are implemented.

Can I save my calculations for future reference?

+Yes, most tax calculators offer the option to save your calculations. This allows you to refer back to your previous calculations, compare results, and make informed decisions regarding your tax obligations.

Are there any limitations to the calculator’s accuracy?

+While the calculator is designed to provide accurate results, it’s important to note that it relies on the information you input. Inaccurate or incomplete data may lead to incorrect calculations. Always ensure you provide the most precise and up-to-date information for the best results.

Can I use the calculator for multiple tax years?

+Absolutely! The calculator is designed to handle calculations for different tax years. This feature allows you to compare tax obligations across multiple years, helping you identify trends and make informed financial decisions.

What if I have a complex tax situation that requires expert advice?

+While the calculator is a valuable tool, complex tax scenarios may require professional guidance. Consider consulting a tax advisor or accountant who can provide personalized advice based on your unique circumstances. They can help navigate complex tax laws and ensure you’re taking advantage of all applicable deductions and credits.