Uncover The Ultimate 1095C Form Secrets Now!

The 1095-C form is a crucial document for employers and employees alike, especially when it comes to reporting health coverage information to the IRS. As a business owner, understanding the intricacies of this form is essential to ensure compliance and avoid potential penalties. In this comprehensive guide, we will delve into the secrets of the 1095-C form, providing you with a step-by-step breakdown and valuable insights to navigate this complex process with ease.

Understanding the 1095-C Form

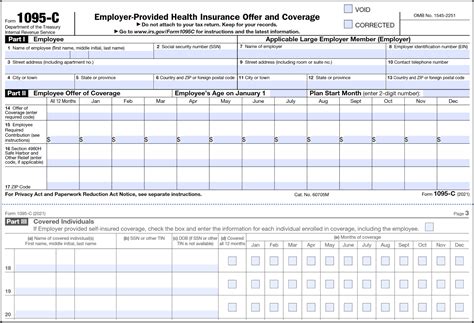

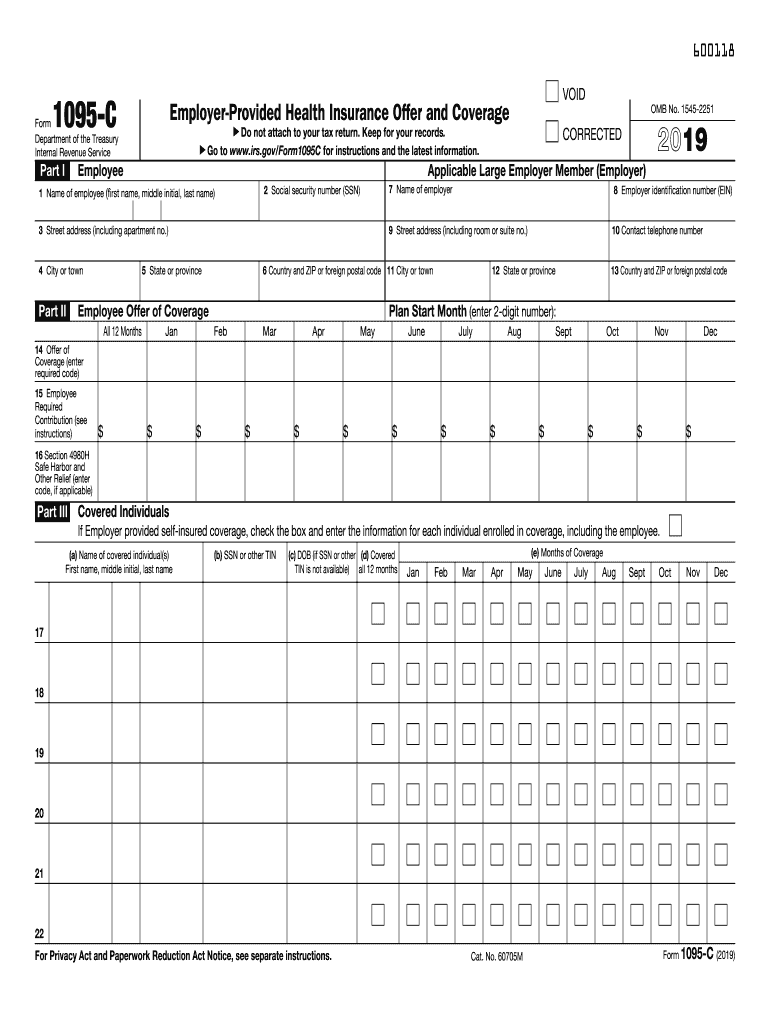

The 1095-C form, also known as the Employer-Provided Health Insurance Offer and Coverage form, is used by applicable large employers (ALEs) to report the health coverage they offer to their full-time employees. It plays a vital role in implementing the Affordable Care Act (ACA) and is an integral part of the annual reporting process.

This form is divided into several parts, each serving a specific purpose:

- Part I: Employer Information - Provides details about the employer, including their name, address, and Employer Identification Number (EIN)

- Part II: Employee Information - Contains information about each full-time employee, such as their name, Social Security Number, and coverage period.

- Part III: Offer of Coverage - Details the health coverage offered by the employer, including the plan type, contribution amounts, and any applicable waiting periods.

- Part IV: Coverage Information - Provides a summary of the health coverage provided to each employee, including the months they were covered and any applicable premiums.

Step-by-Step Guide to Completing the 1095-C Form

Step 1: Gather Necessary Information

Before you begin filling out the 1095-C form, ensure you have the following information readily available:

- Employer details, including the EIN and business address.

- Employee information, such as names, Social Security Numbers, and dates of birth.

- Details of the health coverage offered by your company, including plan types, contribution amounts, and coverage periods.

- Any applicable waiting periods or eligibility requirements for the health coverage.

Step 2: Determine Eligibility

Not all employers are required to complete the 1095-C form. To determine if you are an Applicable Large Employer (ALE), you must meet the following criteria:

- Have an average of at least 50 full-time employees, including full-time equivalent employees, during the previous calendar year.

- Be a member of a controlled group or affiliated service group that employs 50 or more full-time employees.

If you meet either of these criteria, you are considered an ALE and must complete the 1095-C form for your full-time employees.

Step 3: Collect Employee Data

Once you have determined your eligibility, it's time to gather information about your full-time employees. This includes their names, Social Security Numbers, and coverage periods. Ensure that you have accurate and up-to-date information to avoid errors and potential penalties.

Step 4: Fill Out Part I: Employer Information

In Part I of the 1095-C form, you will provide basic information about your business. This includes your business name, address, and Employer Identification Number (EIN). Ensure that you double-check these details to avoid any discrepancies.

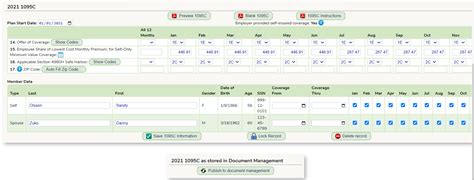

Step 5: Complete Part II: Employee Information

Part II of the form requires you to enter information about each of your full-time employees. This includes their names, Social Security Numbers, and coverage periods. Make sure you accurately record the months during which each employee was eligible for and enrolled in your health coverage plan.

Step 6: Offer of Coverage (Part III)

In Part III, you will provide details about the health coverage offered to your employees. This includes the plan type, such as Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), or High Deductible Health Plan (HDHP). Additionally, you will need to specify the contribution amounts for both the employer and employee, as well as any applicable waiting periods.

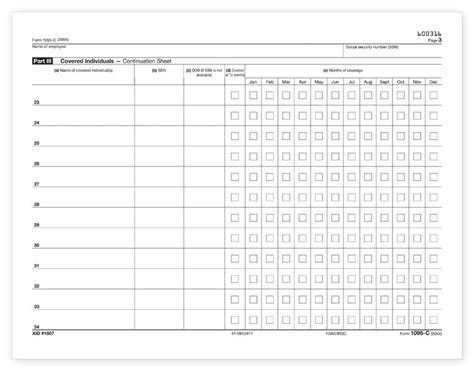

Step 7: Coverage Information (Part IV)

Part IV of the 1095-C form summarizes the health coverage provided to each employee. Here, you will indicate the months during which each employee was covered by your health plan and any applicable premiums. Ensure that the information provided is accurate and consistent with the coverage periods and premiums paid.

Tips and Best Practices

- Use a reliable and secure software or platform to complete the 1095-C form. This will help streamline the process and reduce the risk of errors.

- Double-check all employee information, especially Social Security Numbers, to avoid potential identity-related issues.

- Keep detailed records of your health coverage offerings, including plan types, contribution amounts, and coverage periods. This will assist in accurately completing the form and provide documentation in case of an audit.

- Stay updated with any changes or updates to the 1095-C form and the ACA regulations. The IRS may issue updates or clarifications that could impact your reporting requirements.

- Consider seeking professional advice or consulting with an accountant or tax specialist to ensure compliance and accuracy.

Common Mistakes to Avoid

When completing the 1095-C form, it's crucial to be aware of common mistakes that could lead to penalties or non-compliance. Here are some pitfalls to avoid:

- Incorrect Employer Information - Double-check your business name, address, and EIN to ensure accuracy. Any discrepancies could result in penalties or delayed processing.

- Inaccurate Employee Data - Ensure that you have the correct names and Social Security Numbers for your employees. Mistakes in this section could lead to identity-related issues and potential legal consequences.

- Miscalculating Coverage Periods - Carefully review and calculate the months during which each employee was eligible for and enrolled in your health coverage plan. Incorrect coverage periods could impact the accuracy of your reporting.

- Omitting or Misreporting Coverage Details - Provide complete and accurate information about the health coverage offered to your employees. Failure to do so could result in penalties or non-compliance with the ACA regulations.

Submitting the 1095-C Form

Once you have completed the 1095-C form, it's time to submit it to the IRS. Here's a step-by-step guide to ensure a smooth submission process:

Step 1: Prepare the Form

Ensure that you have accurately completed all sections of the 1095-C form. Double-check for any errors or omissions before proceeding to the next step.

Step 2: Obtain Employee Signatures

The 1095-C form must be signed by each employee or their authorized representative. Obtain their signatures to confirm the accuracy of the information provided.

Step 3: Submit the Form to the IRS

You can submit the 1095-C form to the IRS electronically using the Affordable Care Act (ACA) Information Returns Air Program (AIR). This program allows you to transmit the form directly to the IRS in a secure and efficient manner.

Step 4: Provide Copies to Employees

After submitting the form to the IRS, ensure that you provide a copy of the 1095-C form to each of your employees. This allows them to review and verify the information reported on their behalf.

FAQs

What is the deadline for submitting the 1095-C form to the IRS?

+The deadline for submitting the 1095-C form to the IRS is typically March 31st of the year following the coverage year. However, if you are filing electronically, you may be eligible for an extension until April 30th. It's important to stay updated with any changes to these deadlines.

Are there any penalties for failing to submit the 1095-C form?

+Yes, applicable large employers (ALEs) who fail to file the 1095-C form or provide incorrect or incomplete information may be subject to penalties. The penalties can range from $260 per return to $30 million for intentional disregard of the filing requirements. It's crucial to ensure compliance to avoid these penalties.

Can I file the 1095-C form manually instead of electronically?

+While the IRS encourages electronic filing, you can still file the 1095-C form manually. However, it's important to note that manual filing may take longer to process and could result in delays. It's generally recommended to file electronically to ensure a more efficient and timely submission.

What should I do if I discover an error on the 1095-C form after submission?

+If you identify an error on the 1095-C form after submission, you should take immediate action to correct it. Contact the IRS and explain the situation. They will guide you on the steps to take, which may include filing an amended return or making corrections through the AIR program.

Can I use a software or platform to complete the 1095-C form?

+Yes, using a reliable software or platform can greatly simplify the process of completing the 1095-C form. These tools often provide templates, error-checking features, and automated calculations, making it easier to ensure accuracy and compliance.

Conclusion

Completing the 1095-C form may seem daunting, but with the right approach and attention to detail, it can be a manageable process. By following the step-by-step guide provided and implementing best practices, you can ensure compliance with the ACA regulations and avoid potential penalties. Remember to stay updated with any changes or updates to the form and seek professional advice when needed. With these secrets unveiled, you are now equipped to tackle the 1095-C form with confidence and accuracy.