Video About Credit Score

Understanding Credit Scores: A Comprehensive Guide

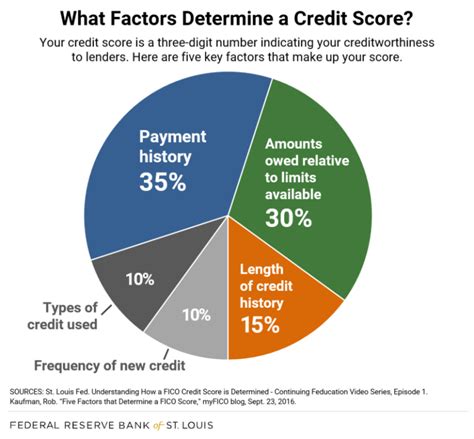

A credit score is a three-digit number that plays a significant role in determining an individual’s creditworthiness. It is calculated based on the information in a person’s credit report, which includes their payment history, credit utilization, length of credit history, and other factors. A good credit score can help individuals qualify for lower interest rates and better loan terms, while a poor credit score can make it difficult to obtain credit or loans.

In this article, we will delve into the world of credit scores, exploring how they are calculated, the factors that affect them, and tips on how to improve and maintain a healthy credit score. Whether you are a credit novice or an experienced borrower, this guide will provide you with the knowledge and insights needed to navigate the complex world of credit scores.

How Credit Scores are Calculated

Credit scores are calculated using a complex algorithm that takes into account various factors, including:

- Payment history: This accounts for 35% of the total credit score and includes information on late payments, accounts sent to collections, and bankruptcies.

- Credit utilization: This accounts for 30% of the total credit score and refers to the amount of credit being used compared to the available credit limit.

- Length of credit history: This accounts for 15% of the total credit score and includes information on the length of time accounts have been open and the age of the oldest account.

- Credit mix: This accounts for 10% of the total credit score and refers to the variety of credit types, such as credit cards, loans, and mortgages.

- New credit: This accounts for 10% of the total credit score and includes information on new accounts and inquiries.

By understanding how credit scores are calculated, individuals can take steps to improve their creditworthiness and maintain a healthy credit score.

Factors that Affect Credit Scores

Several factors can affect credit scores, including:

- Late payments: Missing payments or making late payments can significantly lower credit scores.

- High credit utilization: Using too much credit can negatively impact credit scores.

- Accounts sent to collections: Unpaid accounts that are sent to collections can harm credit scores.

- Bankruptcies: Filing for bankruptcy can have a significant and long-lasting impact on credit scores.

- Multiple inquiries: Applying for multiple credit cards or loans in a short period can lower credit scores.

Being aware of these factors can help individuals avoid common mistakes that can harm their credit scores.

Tips for Improving and Maintaining a Healthy Credit Score

Improving and maintaining a healthy credit score requires discipline and responsible financial habits. Here are some tips to help individuals achieve a good credit score:

- Make on-time payments: Paying bills on time is essential for maintaining a healthy credit score.

- Keep credit utilization low: Using less than 30% of available credit can help improve credit scores.

- Monitor credit reports: Checking credit reports regularly can help identify errors or inaccuracies that can harm credit scores.

- Avoid new credit inquiries: Applying for too many credit cards or loans can lower credit scores.

- Build a long credit history: Keeping old accounts open and maintaining a long credit history can help improve credit scores.

By following these tips, individuals can improve their credit scores and enjoy better financial health.

Credit Score Ranges

Credit scores are typically categorized into several ranges, including:

| Credit Score Range | Credit Rating |

|---|---|

| 750-850 | Excellent |

| 700-749 | Good |

| 650-699 | Fair |

| 600-649 | Poor |

| Below 600 | Bad |

Understanding credit score ranges can help individuals determine their creditworthiness and make informed financial decisions.

📝 Note: Checking credit scores regularly can help individuals identify errors or inaccuracies that can harm their credit scores.

In summary, credit scores play a vital role in determining an individual’s creditworthiness, and understanding how they are calculated, the factors that affect them, and tips for improving and maintaining a healthy credit score can help individuals make informed financial decisions and enjoy better financial health. By following responsible financial habits and monitoring credit reports regularly, individuals can improve their credit scores and qualify for lower interest rates and better loan terms.

What is a good credit score?

+A good credit score is typically considered to be 700 or higher. However, the definition of a good credit score can vary depending on the lender and the type of credit being applied for.

How can I improve my credit score?

+Improving your credit score requires responsible financial habits, such as making on-time payments, keeping credit utilization low, and monitoring credit reports regularly. Avoiding new credit inquiries and building a long credit history can also help improve your credit score.

What is the difference between a credit score and a credit report?

+A credit score is a three-digit number that represents an individual’s creditworthiness, while a credit report is a detailed document that contains information on an individual’s credit history, including payment history, credit accounts, and public records.